There appears to be a lot of caution in the market on Tuesday, which is not entirely surprising given yet another late sell-off in China overnight and the upcoming FOMC decision and statement on Wednesday. Meanwhile, we are seeing a recovery in indices ahead of the U.S. open this morning as oil rebounds from earlier losses.

Given how reactive the market has been to these Chinese sell-off’s in the past – most notably in August and the early part of the year – it’s a little surprising that we’re not seeing more of a flight to safety today. Instead, indices appear to once again be tracking the moves in oil, which has led to them paring much of their losses from earlier in the session.

It’s been another volatile session for oil, with both WTI and Brent crude trading back below $30 earlier in the session only to recover to trade marginally higher on the day. Despite the rally towards the back end of last week, there is clearly still a desire to push prices back to their lows and it will be interesting to see how successful they are today. Yesterday’s sell-off was not overly convincing and suggests a broader correction may be on the cards and the fact that we’ve seen buying into today’s weakness could further support this view.

When we consider that the fundamental factors at play – increased Iraq output, the return of Iran to the market and another rout in China overnight – it would not be unreasonable to expect broad declines in oil today, given how this year has gone so far. Instead the dip has so far been bought which suggests to me that a move back towards $36.50 may be on the cards for both Brent and WTI.

Tomorrow’s Federal Reserve decision and statement will likely be on people’s minds throughout the session on Tuesday, which can often lead to more cautious markets. While the Fed is extremely unlikely to hike interest rates again and no press conference will follow, the statement could contain some important clues as to the pace of tightening this year. Investors will be keen to know whether the rate expectations have changed in response to the China-driven turmoil in the markets so far this year, or the renewed decline in commodities, both of which could add further deflationary pressures to an already low inflation environment. Markets tend to be extremely sensitive to the slightest change in language from the Fed which is why we can often see more caution in the lead up to the release.

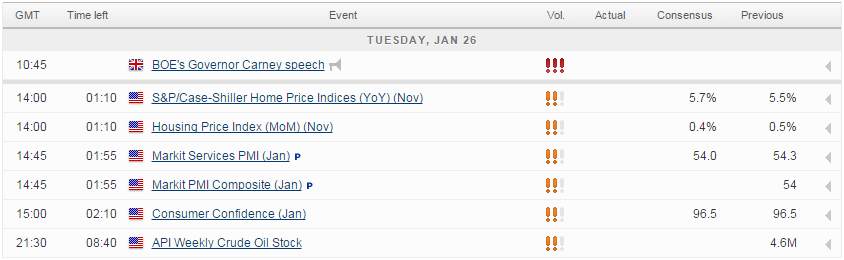

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.