It should be a very interesting couple of weeks for the markets as investors globally react to the Fed’s decision to raise interest rates for the first time in almost a decade. That said, the early signs look positive and a Santa rally now looks on the cards, although as always I remain cautious as this could easily take a significant turn for the worse.

I think Fed Chair Janet Yellen handled the situation very well which was reflected in how the market took everything into its stride in a relatively calm manner. The hike was communicated very effectively and the Fed acted in line with the expectations it had created, while ensuring that it got the message across that futures hikes will be gradual, thereby reassuring investors everywhere that there is no reason to panic. In other words, the Fed retained its credibility, something many have failed to do in what has been a year of central bank blunders.

Given the global impact of a Fed hike, it was very important that it effectively communicated its message on Wednesday and the fact that markets in the U.S. and Asia are in the green and the European session is headed in the same direction, is evidence of this. With the uncertainty surrounding the Fed now cleared and panic not ensuing, everything is now in place for a strong end to the year.

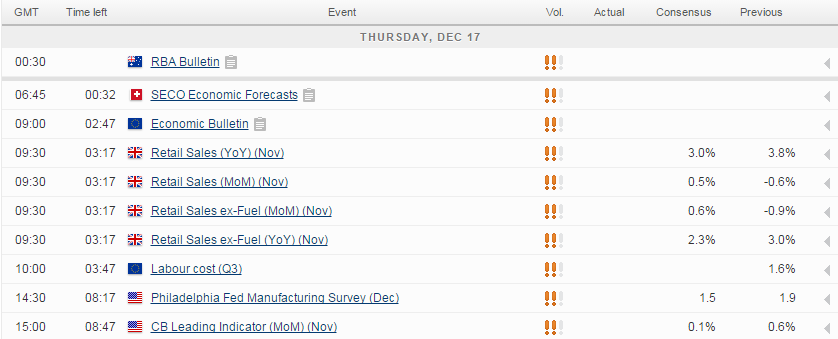

There is plenty of economic data being released on Thursday that should keep markets interesting as we near the end of the week and the holiday season gets into full swing. UK November retail sales will be very important this morning as we get an early idea of consumer spending patterns in the run up to Christmas, a very important time of year for UK retailers. We’ll also get the latest IFO business climate data from Germany, followed this afternoon by jobless claims and the Philly Fed manufacturing index from the U.S..

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.