U.S. equities are expected to build on Wednesday’s gains today, with the hawkish FOMC minutes being the primary driver of the positive sentiment in the markets.

Clearly the removal of the uncertainty around the U.S. rate hike is seen as being far more preferable to investors than keeping them at record lows for a little longer. Everyone may not be in agreement that rates should rise but there is a general acceptance now that it’s happening and the market seems capable of dealing with it. In reality, the economy is performing more than well enough to cope with a small rate increase from the current record low levels and it’s good to see that the market is moving on from the hysteria surrounding it. The path of rate hikes is far more important than the first.

While the first rate hike is looking extremely likely in December following the minutes and the data that has come since, they did leave themselves some room to manoeuvre by claiming that conditions “could well be met” for a hike. While this clearly indicates an intention to rise, it’s very non-committal and with some members not keen on a hike and even wishing to discuss possible easing measures, the Fed has an easy get-out clause. Although it would inevitably come with a credibility cost, something central banks appear less concerned with nowadays.

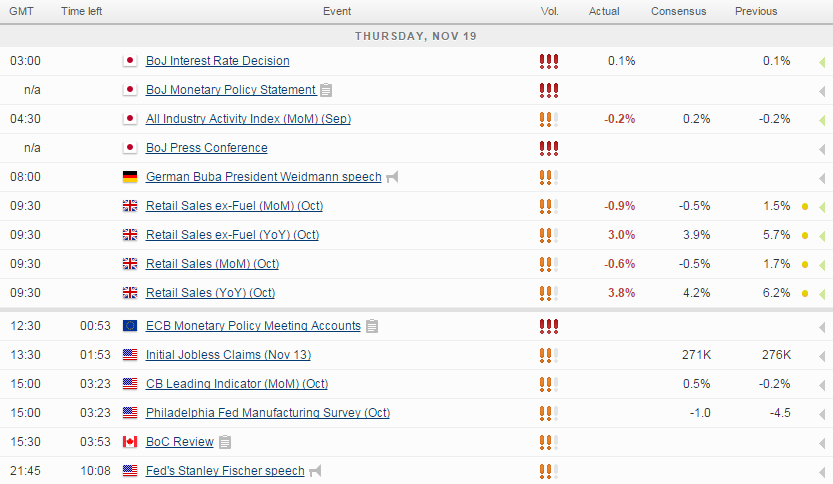

Given the ongoing data dependency of the Fed between now and the December meeting, today’s labour market and manufacturing data will be eyed by traders. The manufacturing sector has faced some significant headwinds this year, primarily due to the stronger dollar making the industry less competitive. While this will clearly be a concern to the Fed, the U.S. is still a relatively closed economy and the sector is far smaller than services so the net impact on the economy should be fairly small. The pace of contraction is also expected to slow for a second month with the Philly Fed survey seen rising to -1 from -4.5. Jobless claims are also expected to fall to 271,000 from 276,000 last week, still well below 300,000 in a key sign of health in the labour market.

We’ll also hear from some Fed members again today, with vice Chair Stanley Fischer and Dennis Lockhart due to speak. We’ll be looking for any change of language from either policy maker than could be perceived to be more dovish, potentially indicating a change of tone from within the Fed.

The S&P is expected to open 9 points higher, the Dow 56 points higher and the Nasdaq 22 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.