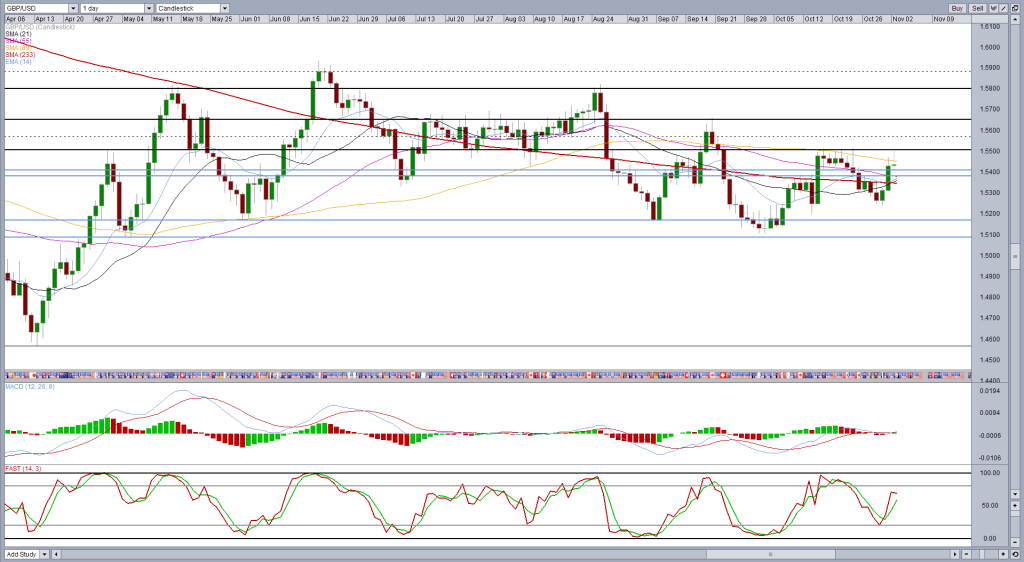

Cable made steady gains again on Monday on the back of stronger than expected UK manufacturing data earlier in the session before running into resistance around 1.55, as it did on numerous occasions in October.

The latest phase of the rally came at a time when the stochastic was making lower highs suggesting momentum in the latest rally is fading. This divergence at what has recently been a key resistance level is not in itself a bearish signal but it does make me less bullish in the short term.

With the pair trading at prior highs with divergence, the only thing that’s missing is a reversal setup which could be seen as confirmation that a consolidation, correction of reversal has occurred.

We could be seeing that now on the 4-hour chart, with a possibly evening star formation appearing. If the current candle closes and confirms this, it would suggest further downside could follow.

Initial support came around 1.54, which held at the first time of asking. A break below here would support the view that further losses lie ahead. Below here, further support could be found around 1.5380 – prior support and resistance – and 1.5350.

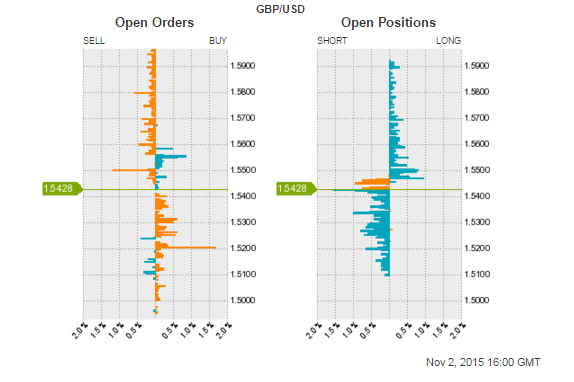

To get access to the OANDA Orderbook and many other trading tools, visit Forex Labs.

To get access to the OANDA Orderbook and many other trading tools, visit Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.