The euro has continued to slide against the dollar today after some heavy selling on Thursday on the back of some very dovish comments from European Central Bank President Mario Draghi.

Having broken through September lows yesterday, the pair looks likely to see further losses in the coming weeks. It is currently finding support around 1.1015, which coincides with the lows set on 18 August.

While this may lead to more consolidation or even a retracement in the short term, I think this may prove to be a temporary support level, with the next key support level possibly coming around 1.09.

An ascending trend line – 13 March lows – could offer support at this level although it should be noted that with only two touches at this stage, this is currently only a speculative trend line. If the pair does find support here it would be the third touch and thus confirm it as a legitimate trend line.

Below here the pair could run into further support just above 1.08, which marks the lows for the pair for the last six months.

If we do see a retracement in the pair from the current support, it will be interesting to see how the pair reacts around 1.11, the September lows highlighted above. A move beyond this would bring the key fib levels into consideration being 38.2% – 1.12 – 50% – 1.1250 – and 61.8% – 1.1310.

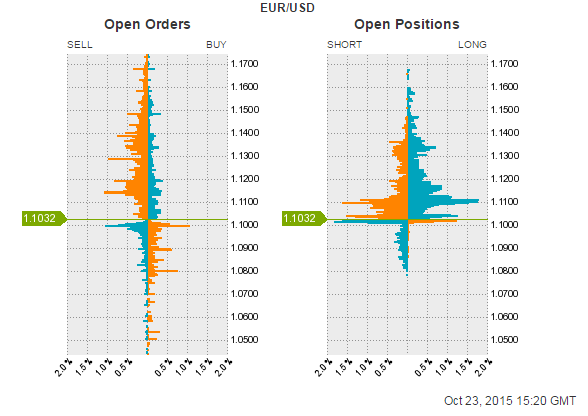

It’s interesting to see on the OANDA order book that 1.10 is clearly a big level of interest. There are a lot of pending buy and sell orders here. It doesn’t necessarily provide bias information at this time as both are roughly equal but it would suggest there’s going to be a lot of activity here.

To find more tools like this, visit OANDA Forex Labs.

To find more tools like this, visit OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.