Europe is expected to open marginally lower on Monday, following a mixed and quiet session in Asia which offer little direction. Japanese markets were closed for Bank Holiday.

There still appears to be a relatively downbeat mood in the markets at the moment. The Federal Reserve’s negative tone following its decision not to raise rates on Thursday is weighing on investor sentiment. Many influential people had been calling for the Fed to leave rates unchanged due to the impact it could have on emerging markets at a time when we’d already seen a fair amount of volatility.

It seems though that it has not received the backing of investors as it both calls into question the strength of the U.S. and global economy and leaves a cloud of uncertainty hanging over the markets. Far too much is made of this first Fed rate hike but it seems that the longer it is put off, the more anxious investors are going to feel about it.

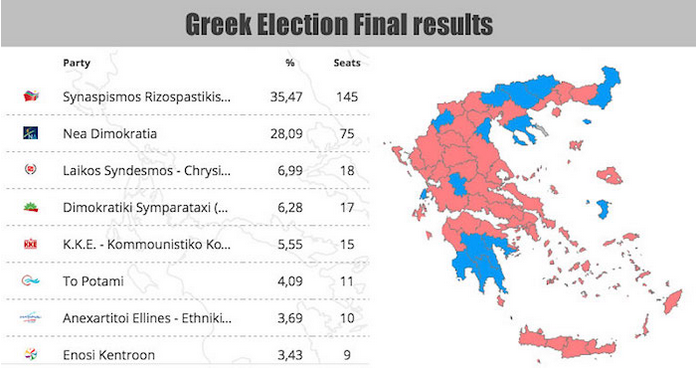

Alexis Tsipras’ Syriza party achieved a convincing victory in the Greek elections over the weekend but once again fell just short of an overall majority having secured only 145 of the 300 seats in parliament. Tsipras will be forced to go into coalition again with small right wing party Independent Greeks which secured 10 seats in the election.

Source – Greek Reporter

Tsipras’ victory was far more comfortable than polls had suggested and has importantly given his party a fresh mandate built on implementing the agreed bailout in full which maintaining a hard line with creditors. This is extremely important given that the previous Syriza government was forced to call new elections after losing the support of many within its own party. There can be no confusion any more, the party now once again has a very clear mandate which it intends to implement over the full four year term.

While the victory ensures more years of painful austerity for the Greeks, it also brings back some welcome certainty and stability which is going to be extremely important for the country going forward. Grexit risks have now diminished and the Greeks have made their position perfectly clear, they want to remain in the euro, even if it means more pain in the short term.

It’s going to be a relatively quiet day from a data perspective, with the only notable release being U.S. existing home sales this afternoon. We’ll also hear from Dennis Lockhart, Fed Bank of Atlanta President and current FOMC voting member. He is the first of a number of Fed officials speaking this week and their comments will be followed closely as investors try to determine when lift-off will finally come.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.