European futures are pointing to another positive start on Tuesday in what is likely to be a livelier day as US and Canadian investors return from the Labor Day bank holiday.

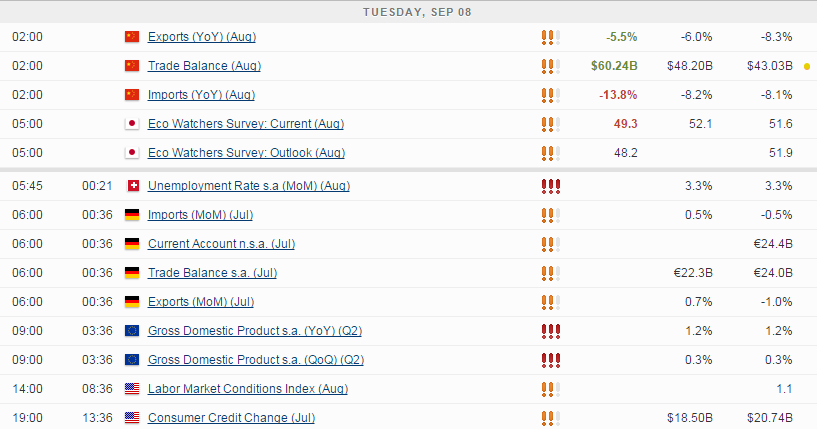

There isn’t a huge amount of important economic data due out today but there are certainly a few to monitor. Revised eurozone GDP data is due out this morning and is expected to be unrevised at 0.3% on the quarter and 1.2% on the year. This will be accompanied by trade data from Germany and France and later on from US labour market conditions and consumer credit data.

Chinese trade data added to the doom and gloom surrounding the world’s second largest economy over night. While the overall trade surplus was just shy of its record, the underlying figures were very disappointing and pointed to slowing demand, both domestically and from abroad.

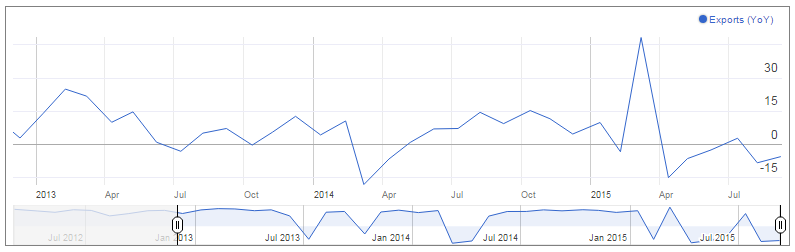

Chinese exports fell by 5.5% last month which was a little better than expected and a slight improvement on last month, but still represents falling demand for Chinese goods.

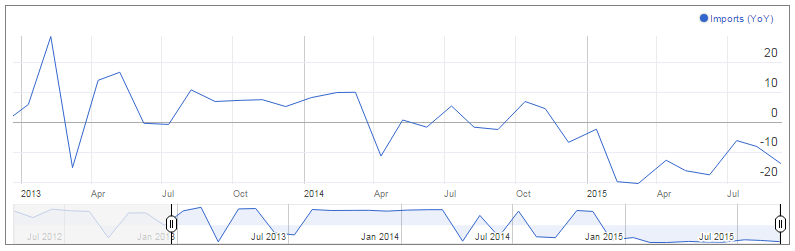

Imports were even worse as falling commodity prices and domestic demand brought about a 13.8% decline.

There have been numerous cases of this already this year and it clearly shows that the country is having difficulties in its attempts to transition from an export-driven economy to a consumer-driven one. The consumer just isn’t filling the void which is going to result in slower growth and challenging conditions for the government and central bank.

Authorities in China have been busy again over the last few days in an attempt to bring some stability to its markets. A statement from the Shanghai Stock Exchange on Monday announced plans for a circuit breaker that would halt trading for 30 minutes if the CSI300 index fell or rose by 5% from its previous closing level. If this failed to stabilize it, it would be frozen for the rest of the day at 7%. The massive moves in Chinese stock markets has been partially attributed to panic selling and over-excitement from the large number of retail investors actively trading them and the idea is that this will help manage that.

This statement from the stock exchange came after the government announced that income taxes on dividends for investments held longer than a year will be removed while those on investments held between a month and a year will be cut in half. The move is intended to discourage short term speculation on the markets that has been behind the huge moves in the markets and created so much panic and fear.

Revised second quarter GDP data from Japan showed the economy shrank by only 1.2% on an annualized basis, from 1.6% in the preliminary reading. The improvement was driven by a build-up in inventories which doesn’t bode well for the coming quarters, especially as capital expenditure fell more than expected. Meanwhile, Prime Minister Shinzo Abe won a second term as head of the Liberal Democrat Party after running unopposed.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.