The euro is looking quite bullish in the short term against the dollar having broken through 1.11, resistance level over the last month, as well as the descending trend line that dates back to 1 July last year.

The move came following the People’s Bank of China’s decision to devalue the yuan, currently down almost 3% against the dollar in two days, which could apply further deflationary pressures to the US. This could encourage the Fed to hold off on raising interest rates this year which is bearish for the dollar.

At the moment, there is nothing to suggest that this is anything more than a relief rally, especially as the Fed is still likely to raise rates soon, just maybe not as soon as was priced in.

The key test of this rally will come between 1.1392 and 1.1534, where the pair faces a number of previous support and resistance levels. It could also face resistance from the descending trend line that dates back to 8 May last year, which intersects the above region.

A failure to break above this level may suggest that the pair has found a new trading range having traded between 1.08 and 1.11 for most of the last month.

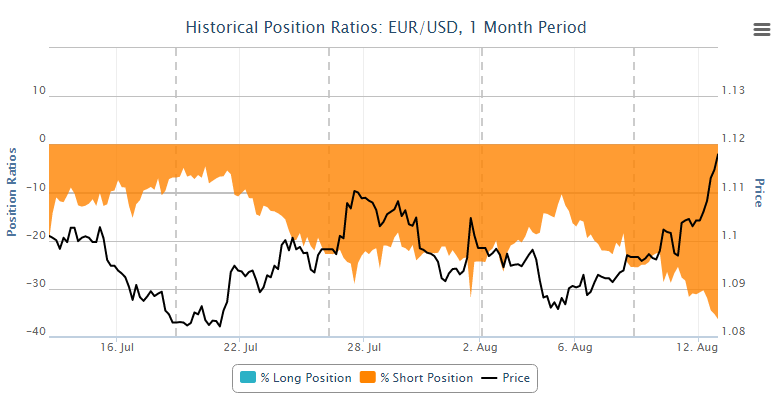

As you can see below, OANDA net client positions have been on the wrong side of the market quite consistently over the last month. During the rally over the last week, net shorts have been growing. Given that net shorts appear to be continuing to grow, this could itself be viewed as a bullish indicator.

The above tools and others can be found in OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.