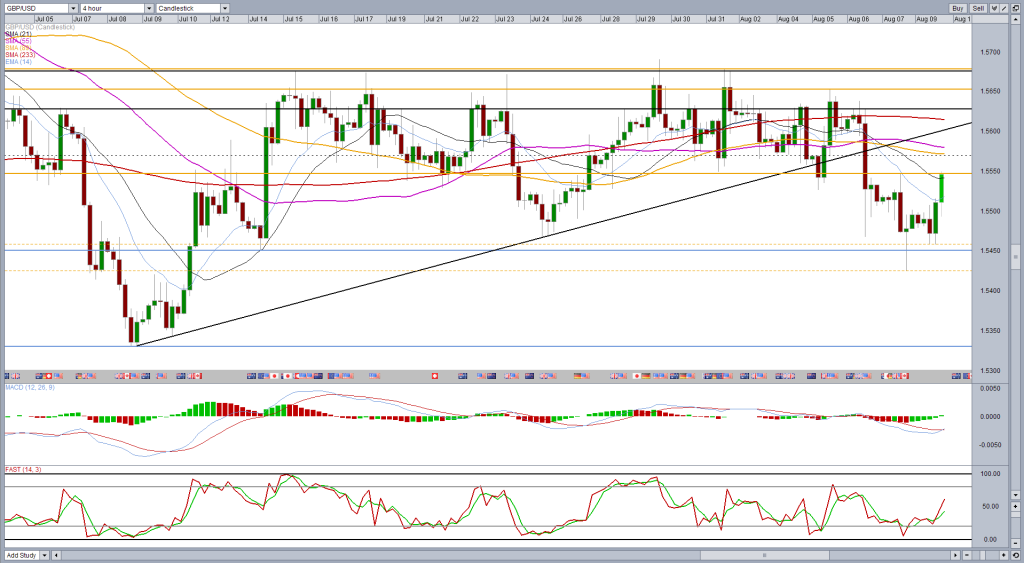

Cable once again bounced off its 89-day simple moving average on Friday and has since rallied and got the week off to a good start, despite some weakness early in the European session.

The failure to break below Friday’s lows this morning could be seen as a bullish signal, especially if it is accompanied by a close above 1.5572 – two thirds of the way into Thursday ‘s candle – which would complete a morning star formation. Some consider this to be the case if we see a close more than half way into it, so above 1.5557.

Even then, I find it difficult to get too carried away. The pair is clearly in some form of consolidation phase which is backed by the fundamental picture of the currencies. Two countries each experiencing decent recoveries with central banks intent on raising rates but being held back by persistent low inflation.

On a technical standpoint, there remains a lot of resistance around 1.5625-1.5675 with the pair having failed to break through here on numerous occasions in the last few weeks.

In the short term, 1.5550 could offer some resistance with it having been a key level on a number of occasions in the past. A break above here would also represent a break above the most recent support and resistance levels, which is significant.

It could also be argued that 1.5550 marks the neckline of an imperfect inverse head and shoulders with shoulders at 1.5458 and head at 1.5425. If this is the case then based on the distance of these from the neckline, it could give a conservative price projection of around 1.5642 and an aggressive one of 1.5675, which coincides with those highs noted earlier.

The above tools and others can be found in OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.