Cable appeared to be struggling to break through the 1.5550-1.56 resistance level yesterday having failed at the first attempt on decreasing momentum.

However, this was never followed by the reversal setup that would have suggested the market had become more bearish and instead gathered some momentum to grind higher to 1.5650. This is a key example of why divergence alone is not a great reversal signal and best when accompanied by price action confirmation.

While the pair broke through 1.56, I feel no more confident in the rally and it once again appears to be lacking conviction. This may have something to do with the fact that the pair is now trading around the 233-day simple moving average, which has previously been a key level of support and resistance. A break above this would suggest there’s been a significant change in sentiment.

The 4-hour chart once again appears to show the pair struggling to gain momentum after breaking through previous highs. The result of these moderately higher highs and the higher lows is a setup that resembles a rising wedge.

It isn’t perfect as the rally in the run up to it isn’t overly strong but for me, the message in it is still clear. Any rallies are being quickly sold into after previous highs are broken, which in my view is a bearish signal. The fact that this is occurring around the 233-DMA suggests to me there’s a lot of indecision around this level. As does the MACD which has hovered around the zero line since Friday.

At this stage, a break above the 233-DMA or below the bottom of the wedge would provide good insight into the next move in the pair. When it comes to ascending wedges in uptrends, the size of the opening can offer insight into the size of the move below, once the level is broken. Of course, this is just a projection based on previous moves and is never guaranteed.

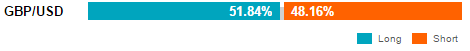

The indecision being displayed in the charts appears to be being felt by OANDA clients who at this stage are only marginally net long having pared their long positions following yesterday’s rally.

*The above tools and many others can be found in OANDA Forex Labs.

*The above tools and many others can be found in OANDA Forex Labs.

N.B The FOMC meeting takes place on Tuesday and Wednesday (16 and 17 June) and will be followed on Wednesday evening with the latest monetary policy decision, a statement, new economic projections and a press conference. This could spark large amounts of volatility in the markets, particularly instruments that are directly impacted by US interest rates.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.