Greece is likely to be the main focal point for the markets again on Tuesday after senior officials from the institutions met in private on Monday evening in order to come to an agreement on what they are demanding from Greece in exchange for the €7.2 billion in bailout funds agreed earlier this year.

While fundamental differences between what Greece and its creditors want to achieve from these negotiations has long been blamed for a lack of progress being made, it’s been no secret that internal differences among the institutions hasn’t helped matters. If they can find common ground, it would hopefully represent some form of progress especially if it included some concessions, for example in the size of the surplus Greece must achieve.

The problem still remains though that Greece and its creditors are unwilling to negotiate on pension and labour market reforms or VAT and until this changes, there will be no deal. At least no proper deal, we can’t possibly write off some form of bridging agreement that keeps Greece afloat a few more weeks and buys negotiators a little more time. Rolling the four repayments due to the IMF this month totaling €1.6 billion would be an example of this and at this stage looks the most likely outcome with the first payment due on Friday.

Repeated claims from Greek officials that a deal has been reached or is near has been a rather bizarre occurrence over the last week as they have been shot down each time with officials from the creditors claiming a deal isn’t even close. This has turned into a daily occurrence now so we should probably expect more of the same in the coming days, although reports are no longer getting much response in the markets.

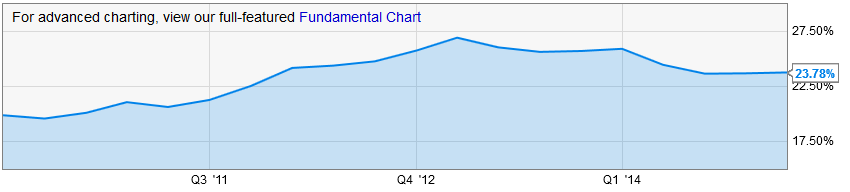

Unemployment data from Germany and Spain will also be eyed this morning. Both are expected to fall with the former looking for an eighth successive decline that would keep the unemployment rate low at 6.4% and the latter a more substantial 115,500 reduction. Spain’s recovery recently has been very encouraging although we have to remember its coming from a very low base having suffered through years of painful austerity and very high unemployment. Even now there is 23.7% unemployment in the country down from highs of 26.9% in the first quarter of 2013.

Source: YCharts

Source: YCharts

With so much slack in the eurozone economy, inflation is going to continue to be hard to come by although it is being helped at the moment by the rise in energy prices which have rebounded off their lows this year. We’ve seen from the data recently that the weaker euro isn’t really boosting exports too much yet and any increased import prices as a result are generally being absorbed by companies desperately trying to remain competitive. As long as this continues, inflation will remain subdued barring the swings caused by oil price moves. Wage growth in the region is a long way off at this stage. A rise to 0.7% from 0.6% is expected from today’s flash CPI reading for May.

In the UK, the construction PMI is expected to slightly reverse the recent downward trend, rising to 55.1 in May. As the economy cools, we are seeing more evidence that it is becoming increasingly unbalanced with a growing reliance on the services sector. Granted, this isn’t currently being helped by the stronger pound weighing on the manufacturing sector but it is clear that not enough is being done to rebalance. Construction is one area where we could do with seeing a boost but it seems that for now the sector, while still growing, is destined to do so at a slower rate.

The FTSE is expected to open 15 points higher, the CAC 14 points higher and the DAX 10 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.