European markets were given a boost on Monday by reports that Alexis Tsipras has reshuffled his negotiating team, effectively side-lining Yanis Varoufakis who’s tough negotiating stance has prevented any progress being made in recent months. Those gains are not currently expected to carry through into Tuesday but that is not a reflection on people’s optimism over a deal being done with people now appearing far more confident.

We may have to wait for a week or two for the deals to be thrashed out but at least the people in charge of the negotiation process are now experienced in these kinds of discussions. It makes a deal far more likely in time for the next eurogroup meeting which takes place on 11 May.

We could see further progress being made on Wednesday, when the Brussels group meets in person to continue discussions on Greek reforms. It was also reported yesterday that Greece has revised its list of reforms and is ready to suspend its minimum wage plans. This is the first real sign of compromise we’ve seen during these discussions which again suggests we’re finally seeing progress being made.

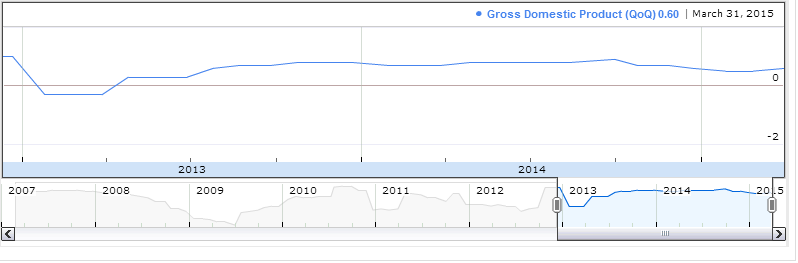

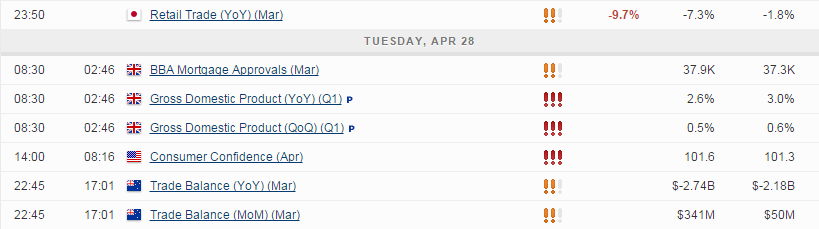

With the UK election only a little over a week away, all major data releases will be monitored very closely and could have a part to play in an election that is largely centered around the economy. This morning’s preliminary release of first quarter GDP is expected to show growth of 0.5%, down slightly from the previous quarter but still 2.6% higher than the same period a year ago.

*Taken from the Market Pulse economic calendar.

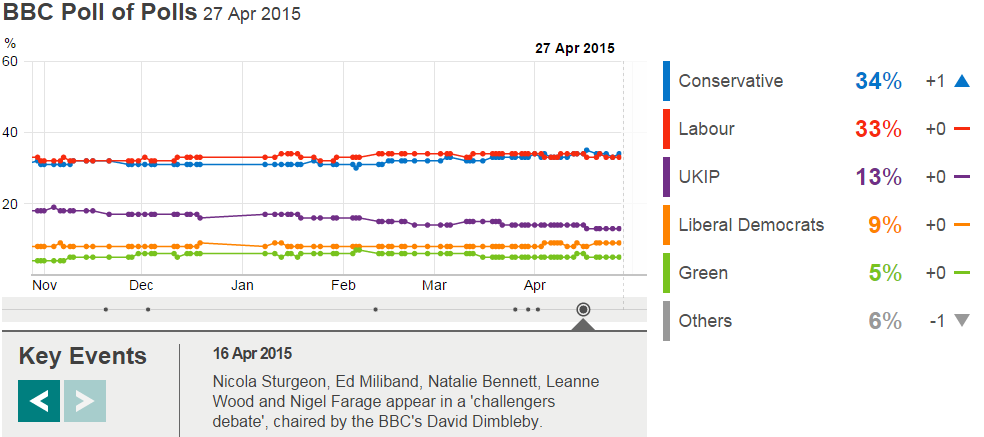

The UK has been growing at a good rate over the last year and a half but that has started to taper off slightly, which is to be expected following such a strong improvement. The question is, can David Cameron and the Conservative party get the message across to the voters that the economy is on the up despite the fact that many claim to feel worse off. It’s a message he’s struggling to get across at the moment despite the fact that the country is exhibiting faster rates of growth than many other developed countries. Given his failures so far, I wonder whether even a stronger growth figure today will help Cameron at all.

*Taken from BBC poll tracker, which can be found here.

Retail sales in Japan collapsed in March compared to a year earlier, even more so than people were expecting. The number was always going to be woeful because of the surge in spending last March ahead of the sales tax hike but sales were also down 1.9% compared to February, which points to a much bigger issue.

Consumers should currently have a big of extra cash as a result of lower oil prices but these figures suggest that instead of spending it, they are saving which is bad news for an economy in which consumer spending contributes around 60%. The numbers have increased calls for the Bank of Japan to step up its QE program, which could come as early as Thursday when they will make their latest decision.

The FTSE is expected to open 12 points lower, the CAC 23 points lower and the DAX 33 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.