European indices are expected to open slightly in the green again on Wednesday, despite the ongoing saga in Greece which could lead the country to default on its debt and even leave the eurozone.

People are becoming increasingly uncertain over the future of Greece and yet equities are still moving higher because as long as the European Central Bank continues to pump €60 billion a month into the financial system, these upside pressures will remain. You only have to look at the yield on two year Greek debt, which has risen above 30%, to see that the moves in equity markets do not reflect overall sentiment.

*The above chart and data came from investing.com.

If anything, they could actually be seen as a safe haven play because regardless of what happens in Greece, €60 billion of fresh liquidity will continue to come from the ECB each month. Germany remains the most favored place for investors to park their cash despite the extremely low returns, with the 10-year Bund now yielding only 0.1%.

The pressure on Greece will be ramped up in the coming weeks and reports yesterday suggested that the ECB may look to review the emergency liquidity assistance program that is currently keeping Greek banks afloat. The central bank is caught in a tight spot because it currently holds a significant amount of Greek debt on its balance sheet and while it won’t want to contribute to the default, it will feel like it needs to pile the pressure on Greek leaders to reach an agreement with its lenders in order to receive the €7.2 billion bailout extension.

An agreement still looks extremely unlikely this month despite Greece’s initial promise to come to an agreement on reforms by the end of April. It’s moves earlier this week to raise around €2 billion from public sector reserves may have bought the country a little more time, although what it thinks it can achieve with it is beyond me.

The Bank of England will release the minutes from this month’s meeting this morning and once again they are likely to show a unanimous vote against raising interest rates or changing its asset purchases. At one stage it had looked as though support was appearing for the first rate hike but since then inflation has fallen to 0%, largely driven by falls in oil and food prices, leaving policy makers with little choice but to hold off for now.

This afternoon we’ll get the latest existing home sales figures from the US, along with crude oil inventories from the Energy Information Administration. The latter will be of particular interest given the volatility in oil prices at the moment, especially with people anticipating a decline in inventory builds in the coming months to reflect the significant decline in oil rigs in operation. This could offer further support to oil prices, which have rebounded off their lows.

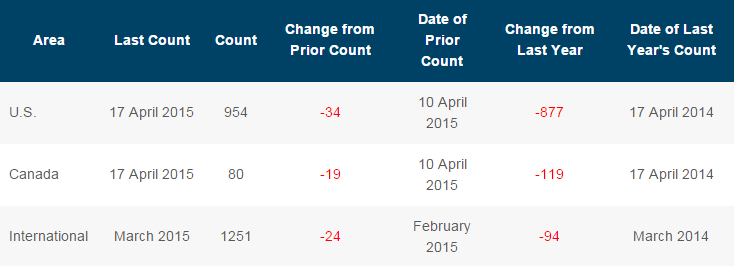

*This oil and gas rig count data was taken from the Baker Hughes website.

The FTSE is expected to open 2 points higher, the CAC 9 points higher and the DAX 28 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.