Cable’s recent rally has had many questioning whether what we’re seeing here is a resurgence in pound or simply a correction in the dollar following a strong rally in the second half of last year. While the dollar is arguably due a correction following six impressive months, I think the evidence would point to the latter.

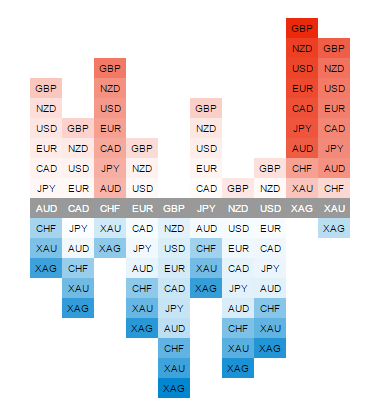

As you can see from the currency strength heatmap table below, sterling has been the best performing currency among the majors over the last month. Clearly then the strength of the pound is playing into this. You’ll also see only GBP and NZD have outperformed USD over that period so clearly the cable pair is a clash of the titans right now and GBP is currently winning the battle. This may be helped by the fact that we’d had so much weakness in the pair in the second half of last year creating value for the bulls.

The main reason behind the sterling rally has been the more hawkish tone from the Bank of England which has driven people to bring forward their rate hike expectations from early 2016 to the end of this year. Disinflation leading to deflation in the UK had prompted people to initially push back rate hike forecasts but the insistence from the BoE that were seeing positive deflation rather than broader based bad deflation has forced people to revise their forecasts.

From a technical standpoint, the pair continues to look bullish. The 61.8 fib of the move from 27 November highs to 23 January lows has finally been broken at the third time of asking, taking out what was also previously a strong support level.

It is currently finding support again around 1.5540, again a previous level of support and could run into further difficulties between 1.5560 and 1.5580. Between these two levels the 100-day SMA could provide resistance and once again there are a number of previous support levels that may now act as resistance. The 20-week SMA also falls around this levels and again could act as a barrier with the pair having previously responded strongly to it and traded below it since the end of July.

While all of these may provide resistance, I’m not convinced it will provide a ceiling for the pair as there is currently no signs that the rally is losing momentum. Both the MACD and stochastic on the daily and weekly charts are showing increasing momentum and are the candlestick setups. Should we see a break of these levels it could suggest a lot more upside to come and the next levels that really stand out to me are 1.5850 – 1.59, big previous support levels, and 1.6050 – 1.61, 50% retracement of the move from 15 July highs to 23 January lows and the 200-day SMA.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.