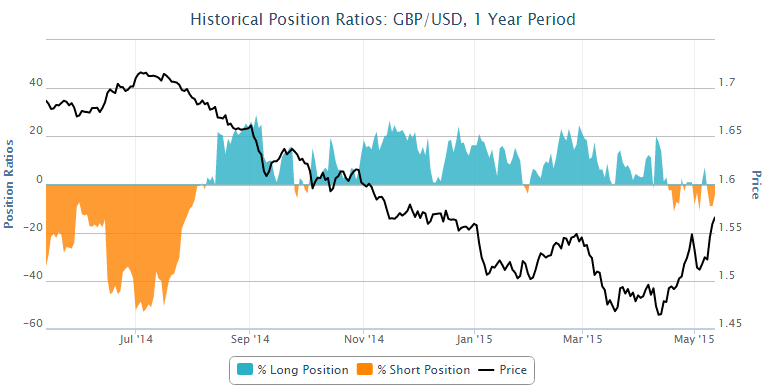

Sterling has been the strongest performing major currency over the last month but after a strong post-election rally, it may begin to be losing a little steam against the dollar.

Cable is about to face a huge test of its longer term strength as it approaches a cluster of previous support and resistance levels and the 233-day simple moving average.

Additionally, this level marks the 50% retracement of the entire cable sell-off that started almost a year ago.

As the pair approaches this level, both the stochastic and MACD histogram on the daily chart suggest the rally may be losing some momentum. I wouldn’t say the bearish divergence is complete at this stage but it certainly looks like that will be the case. A bearish divergence also wouldn’t guarantee that a reversal will occur now, just that it may occur soon as momentum is being lost.

As of yet, I haven’t seen an actual reversal signal and that may not happen until it reaches the 1.5780 – 1.5880 range. If I see a reversal pattern around this area, such as a double top, head and shoulders, or even a single or double candlestick formation such as shooting star or bearish engulfing pattern, I would expect to see a bounce off this level.

This could suggest that the longer term dollar rally is ready to resume, following a month-long correction. An early sign of this could come from April 29 highs being broken, or better still 5 May lows. Below here a break of last month’s near-five year lows would provide further confirmation.

A break above the 1.5780-1.5880 region would be very bullish in my view, with the next big resistance level coming around 1.62, the 61.8% retracement of the previous move and a previous level of support and resistance.

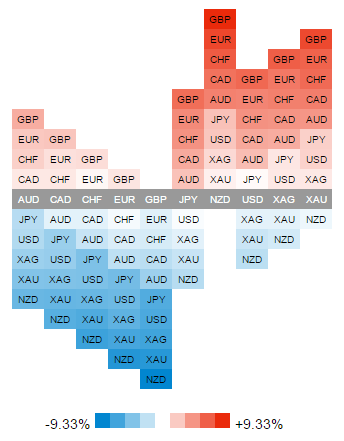

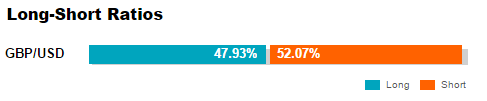

Further insight into client positions and currency strength, among many other things, can be found on the FX labs section of the OANDA website.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.