Tech Taking Another Hammering

The US is returning after the long bank holiday weekend to a lively session on Tuesday, with tech stocks once again leading the way lower and braced for more turbulence.

The recovery late Friday may have been short-lived, with the sector coming under heavy pressure across Europe and the big US names that have propelled US indices back into record territory coming in for a difficult session. Of course, put in perspective, most of these stocks haven’t even hit one month lows yet so there’s arguably plenty of room below.

The premature dip buying on Friday though does show that there’s still plenty of interest in these stocks, despite the sharp drop, with investors likely sensing opportunity from the discount they’re now trading at compared to their peaks last week. That may not protect the share prices in the immediate future but I can’t see it lasting too much longer.

Apple was almost 20% off its high before it recovered on Friday, Amazon more than 12% and Alphabet more than 10%. Tesla, which was up almost 500% from its pandemic lows at Friday’s close, was down more than 25% from its peak at one stage. I can’t see investors losing interest any time soon but they may allow for a bit more of a discount.

Tesla is off 10% pre-market following the S&P 500 snub last week, which should see it trading close to last week’s lows around the open, assuming no change between now and then. I don’t think it’s too big a blow for the company, although near-term it means it will miss out on the additional interest from index tracker funds. There’s an inevitability now though about its admittance, assuming it can maintain its performance, both in terms of price and profit.

On a broader note, this is just a minor setback at a bad time for the stock. We’ve seen it all before, profit taking kicks in and any negative headline is leapt upon which accelerates the move. I don’t think we’re seeing anything more than that right now. These were frothy markets, now they’re less so.

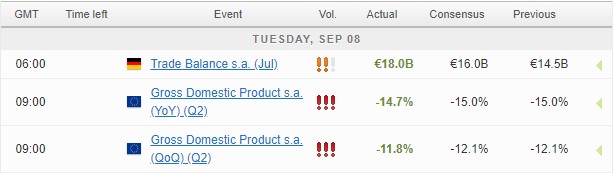

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.