Another Blow For Travel and Tourism

European stock markets are ending the week on a sour note, as rising Covid numbers on the continent force the UK government to impose stricter travel restrictions.

This comes just as the travel and tourism sector was starting to get back on its feet after being desimated by the pandemic, with countries going into lockdown, borders closing and planes remaining grounded. The decision to add France to the list of quarantine countries affects a huge amount of British holidaymakers and adds the country to a list of frustrated holiday destinations – that also includes Spain – that depends on travelers from the UK.

The decision is not going to be welcomed with open arms here in the UK either, with holidaymakers already in France now being subject to costly return journey’s, assuming they can do it at all before tomorrow’s 4am deadline, or a two week quarantine. The price of travel has naturally soared due to the increased demand, piling further misery on those forced to return.

What’s more, the move by the UK government is unlikely to come without reciprocation, meaning UK businesses that rely on tourists from France and other that have been added to the list will also suffer. The government claims the move is necessary to keep numbers in the UK low, having been heavily criticised for its laboured decision making back in March. Now if cases surpass 20 per 100,000 on average over seven days, quarantine will follow, clearly without any exception.

The moves in Europe haven’t had too great an impact on sentiment the other side of the pond, with futures only off around half of one percent. US traders will be far more concerned with the retail sales data, due shortly before the open, with spending seen rising another 2% in July, following an impressive bounceback in May and June. The additional restrictions in response to the sharp rise in cases and deaths from Covid will likely have taken its toll on spending last month and may continue to in the near-term.

Oil slips as IEA lowers oil demand forecasts

In-keeping with the latest developments in the UK, IEA lowered its global oil demand forecasts for this year and next due, in part, to lower air travel, with July seeing two thirds fewer flights than the same month last year. Oil prices weren’t overly thrown by the more gloomy forecasts, with crude off around half of one percent today, pulling a little further off the upper end of its recent range. The ever-evolving Covid situation makes forcasting anything too far into the future exceptionally difficult and subject to significant revisions, which perhaps explains the limited response to the downgrade.

Precious metal recovery stalls as real yields rise back above -1%

The gold recovery trade over the last couple of days has run out of steam, with the yellow metal slipping a little today after running into some resistance aorund $1,960. Real 10 year yields in the US slipped back below -1% on Thursday but have climbed back above here which has taken the edge off the precious metal comeback.

Silver is suffering a similar fate but, being gold’s more volatile sibling, its doing so in more dramatic fashion. A 15% decline earlier this week was followed by an 11% recovery and now a 3% decline on the day. If it wasn’t for bitcoin, I’m sure this would raise a few more eyebrows. As it is, it’s just another day in the crazy world we’re living in.

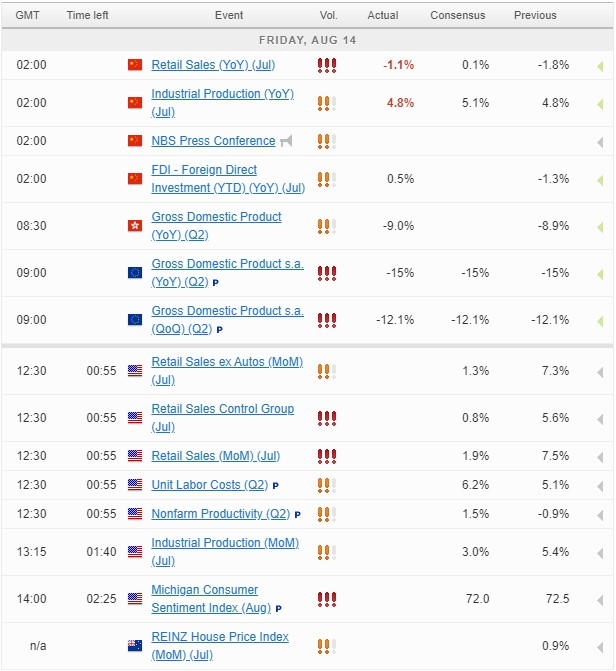

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.