With the Federal Reserve opting to remain coy on Wednesday, investors once again find themselves studying the economic data and trying to determine whether it satisfies policy makers requirements in order to raise rates in September.

The FOMC statement this month was barely changed from June’s but the changes that were made were slightly hawkish. It’s very difficult to quantify what “some” further improvement in the labour market actually represents. All we can really say is this represents a softening in the requirements from the month before so maybe something similar between now and September will tick the box.

The other key change was the view that “underutilisation of labour markets has diminished”, rather than “somewhat diminished”, as per the June statement. Again, this is only a slight improvement but it does suggest the Fed is now satisfied with the level of slack in the economy and with the rate at which it is being diminished.

The biggest thing that is holding the Fed back right now is the inflation outlook and how confident it is that it will return to its 2% target. The decline in oil prices over the last 12 months played havoc with the numbers and the continued weakness in commodity prices is likely to continue to do the same going forward. The Fed seems confident that this will not impact inflation expectations and therefore future inflation rates but I think it’s simply holding out for more evidence of this before acting. Especially as any rate hike will only add further downward pressure on inflation.

Today’s reading of second quarter GDP will offer some insight into what the Fed is dealing with, from an economic standpoint. The U.S. economy performed poorly in the first quarter due to a number of factors, one of which – the strong dollar – was a headwind again in the second and will continue to be if the Fed hikes interest rates.

Still, growth of 2.6% on an annualized basis is forecast which would be decent under ordinary circumstances. Unfortunately, given the lackluster -0.2% reading in the first quarter, it is pretty borderline. Both the second quarter reading and first quarter revision will be watched very closely and heavily analysed to support the argument either for or against a rate hike. The result could be a lot of volatility around the release, especially if the numbers are wide of expectations.

We’ll also get jobless claims figures today which, while being important, don’t attract much attention as they are quite consistent strong. A small rise to 270,000 from 255,000 is expected today, which would still be very strong. Another notable release today is the trade balance figures for the U.S. as it will further highlight the impact of the strong dollar on the economy.

The S&P is expected to open 2 points lower, the Dow 13 points lower and the Nasdaq 2 points lower.

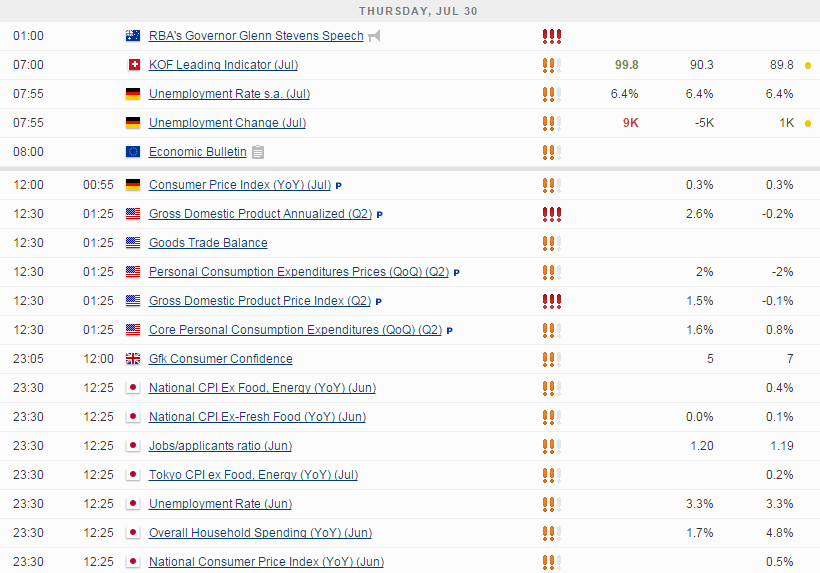

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.