Investors Buoyed By Softening Trade Stance

There are a lot of risks that financial markets have shrugged off over the last couple of years, to the amazement at times of investors, but the prospect of a trade war is clearly not one of these.

European markets are following Monday’s lead on Wall Street and posting substantial gains this morning, while US futures are pointing to another strong start on Tuesday. It has become clear that the main target of Donald Trump’s tariffs on steel and aluminium was China, with a number of other countries being granted extensions and possible exclusions since the announcement, while the threats have intensified towards Beijing.

Naturally, the prospect of a trade war between the world’s two largest economies has weighed heavily on risk appetite over the last couple of weeks with US equity markets posting significant losses on Thursday and Friday as things heated up. The message over the weekend though was far less confrontational and suggested the US would be open to scrapping the tariffs in exchange for certain other concessions such as reduced tariffs on important cars.

Ultimately, Trump’s target was and remains to reduce the county’s sizeable trade deficit with a number of countries and while he may give the impression that a trade war is a worthwhile sacrifice, I’m not sure he’s as keen on it as he makes out. The question now is how big a concession other countries are willing to make to appease him, if any, and whether it will be sufficient enough for him to sell it to US voters as a worthwhile victory. Given the reaction we’ve seen in markets over the last couple of week’s I don’t think he’ll be keen to follow through on his threats and risk sending markets into a tailspin.

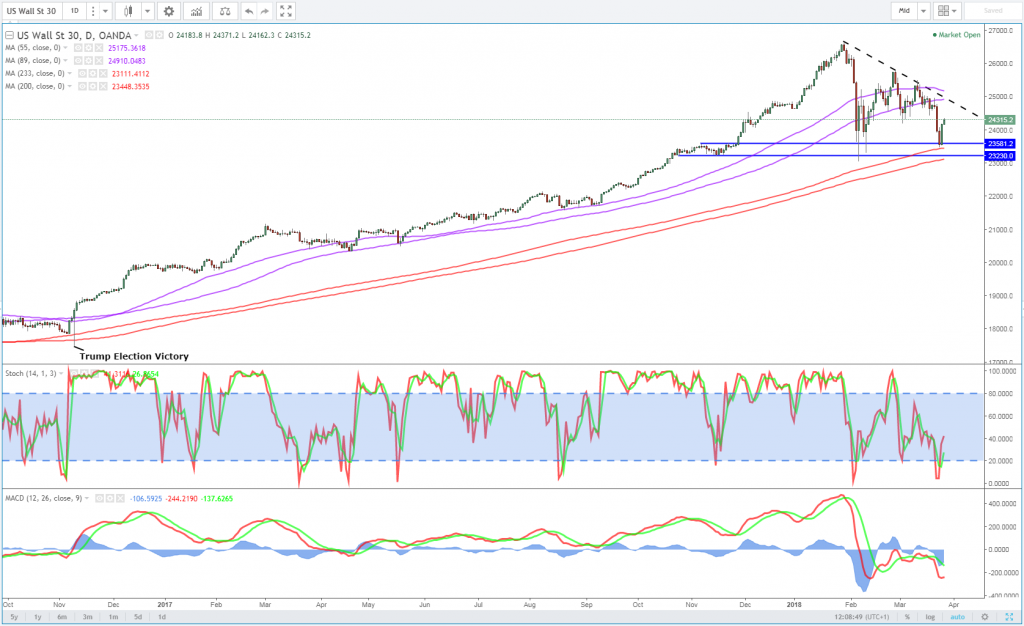

Dow (US30) Daily Chart

OANDA fxTrade Advanced Charting Platform

More Countries Join UK in Expelling Russian Diplomats, Investors Not Concerned

Political stories are likely to continue to dominate financial markets this week in the absence of any major planned economic events. The calendar is looking much quieter than it did this time a week ago, putting increased focus on the developments on trade and other matters. Increased tensions between Russia and the West is another story that will continue to be monitored but hasn’t had much of a market impact, if any.

The UK will be delighted with the backing it’s had from its allies in the West, with a number of countries including the US having expelled Russian diplomats in response to the evidence offered by the UK in relation to the poisoning of former spy Sergei Skripal and his daughter. While Russia continues to deny any involvement, more than 100 diplomats have now been expelled by more than 20 countries which has threatened to increase tensions. Investors will be monitoring the situation closely to see whether the situation develops into something that could rattle the markets.

EUR/USD – Euro Dips, US Consumer Confidence Next

US Data and Bostic Speech in Focus

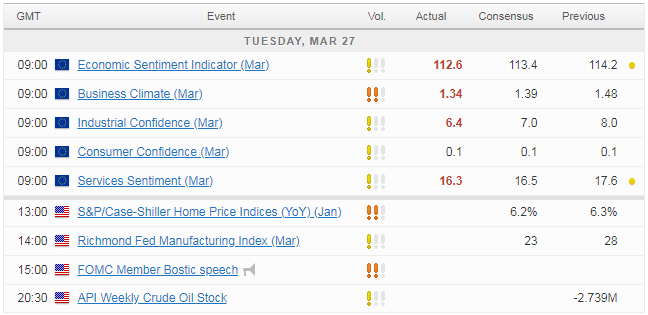

It’s looking a little light on the data side today, with CB consumer confidence from the US the only notable release. We’ll also hear from Raphael Bostic, a voter on the FOMC this year, who on Friday suggested he expects to see three rate hikes this year. It’s unlikely much has changed since then so market impact may be limited.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.