Markets Gradually Recovering But Remain Vulnerable

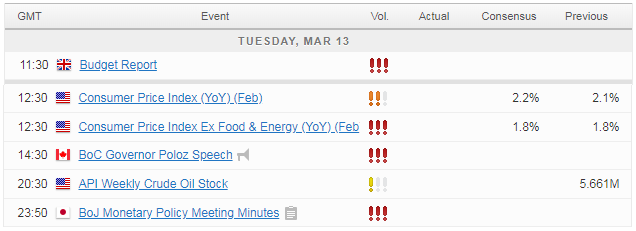

The next 24 hours will be of particular interest to traders in what is otherwise expected to be a relatively quiet week, with US inflation and retail sales data in focus.

US markets continue to gradually recovery from the sharp sell off at the start of February, which at the time was triggered by fears over a faster pace of tightening from central banks. While investors appear to be coming to terms with the idea of more rate hikes, some caution remains, especially as this has also come at a time when Donald Trump is threatening a trade war with countries that don’t improve the terms of trade for the US.

Investors may be coming around to the idea of more rate hikes but as we have seen over the last month or so, with volatility remaining elevated and indices off their record highs, they’re not exactly thrilled with the idea. That should make next week’s Federal Reserve meeting all the more interesting, as we’ll get a better idea what policy makers are expecting this year, with new economic projections being released.

DAX Ticks Higher, Investors Eye German CPI

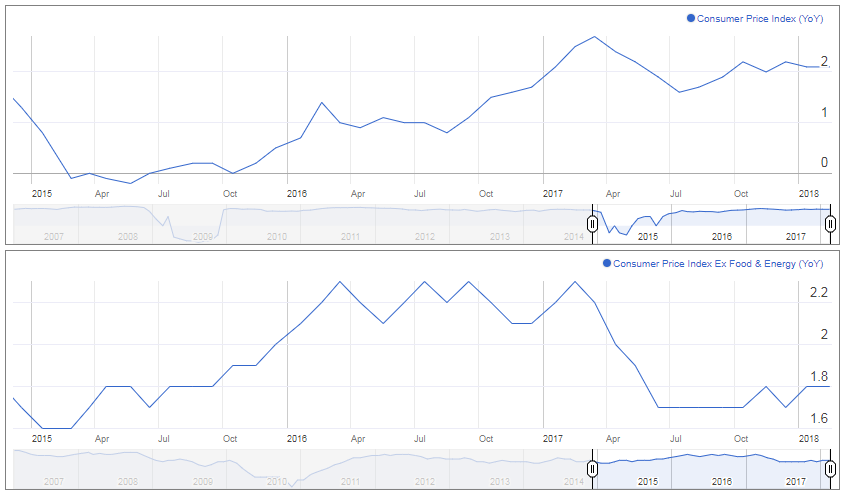

CPI Data Key Ahead of Next Week’s Fed Meeting

Today’s inflation release – while not being the Fed’s preferred measure – will offer some insight into the direction of travel for US prices at a time when the labour market is tight and tax reform is providing an additional stimulus. As we saw on Friday though, there may be more slack in the labour market than the central bank was factoring in and so traders and policy makers will be looking at wages and inflation data for clear signs that the data is confirming their forecasts.

US Inflation

I’m not sure a slight uptick in inflation to 2.2% and core inflation remaining at 1.8% will provide policy makers with much comfort or confidence next week but they may be encouraged that it is at least headed in the right direction. A miss on the other hand, on top of Friday’s report, may give policy makers reason to hold up on revising up interest rate expectations next week, which could weigh on the dollar and support stocks in the near-term.

Markets Look for a Second Opinion on U.S Inflation

UK Spring Statement Likely to Be a Very Forgettable Event

The other event of note today will be the Spring Statement in the UK, in which Chancellor Philip Hammond will provide new forecasts for the economy and an update on the public finances. While this has historically been the time of year when the Chancellor announces changes to spending and taxation, that’s changed as of this year and will now take place in the Autumn which will likely make today more of a forgetful affair.

Hammond is expected to announce that the UK grew more than previously expected and tax receipts have also been higher, something he’ll be keen to stress is a result of the government’s fiscal prudence. This is likely to be more of a self-congratulatory affair despite the hopefulness of some that the Chancellor will ease the austerity a little as a result of the better than expected financial situation. Those hoping for more money for public services which have been strained for years are likely to be disappointed, with any decision on this likely put off until the Autumn budget.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.