Two days of decent gains appear to have taken their toll on European equity markets with futures pointing to a slightly softer open on Thursday.

This appears to just be a case of profit taking from traders following what has been an unusually positive couple of days when compared with the rest of the month, which has been characterised by indecision and tight trading ranges. Given that we have two major risk events for the markets in the coming weeks –E.U. referendum in the U.K. and possible rate hike from the Federal Reserve – I do wonder though whether this rally has the legs to build significantly on the moves of the last couple of days.

Of course, it is being supported by firmer oil prices with Brent crude having finally drilled through the $50 psychological barrier for the first time in six months. The EIA crude inventory number confirmed the API data on Tuesday – and potentially the belief that the oil market is currently in deficit if not only temporarily – with stocks falling 4.2 million last week, the second time in three weeks that they have declined.

Oil Unchanged, Crude Oil Inventories Posts Sharp Decline

This move does appear to have been coming for the last couple of weeks, the question now is whether it can establish itself in a new range between $50 and $55. While supply disruptions are likely to continue to support prices for now, a further strengthening in the dollar over the next couple of months could act as something of a counterweight and keep prices in check.

This morning we’ll get the second estimate of U.K. GDP for the first quarter, which isn’t expected to be any less bleak than the first estimate we had last month. The initial figure showed growth slowed to 0.4% in the first quarter, most likely assisted by the uncertainty surrounding the E.U. referendum in June which is likely to continue into the current quarter. With this in mind, the first half of the year is all about damage limitation and whether the economy can continue to tick along in such a way that its able to rebound in the second half, assuming of course that the country votes to remain in the E.U..

This afternoon we’ll get durable goods orders data from the U.S. and hear from two voting FOMC members, Jerome Powell and James Bullard. Bullard has been very vocal this week and has repeatedly tried to remain relatively balanced while appearing to show a preference for a summer rate hike, dependent on the data of course. Powell is typically among the more neutral members of the Fed so it will be interesting to see whether he conforms to the recent hawkish stance from a large number of policy makers.

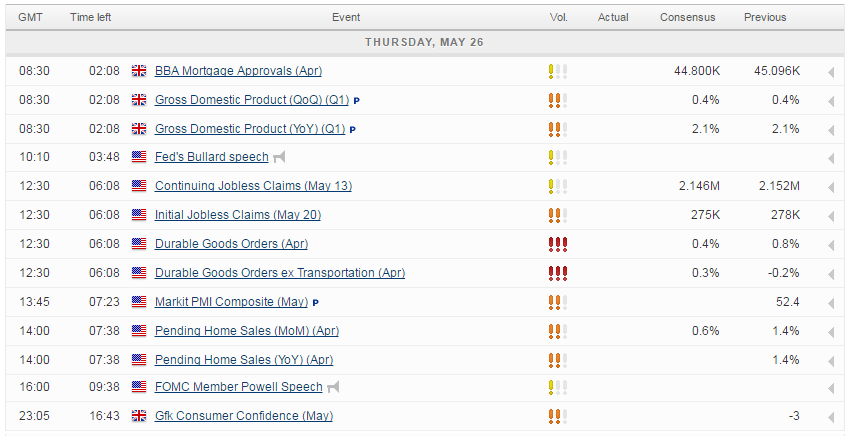

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.