Monday September 10: Five things the markets are talking about

Trade talks, tariffs threats, EM contagion fears and central bank decisions are dominating asset price moves this month.

Add geopolitical risks and U.S impeachment possibilities, market volatility is expected to remain elevated for some time.

Global equities are trading mixed, with Euro stocks drifting while U.S futures are a tad higher after losses in Asia as the market continues to weigh the possibility of escalation of a Sino-U.S trade war.

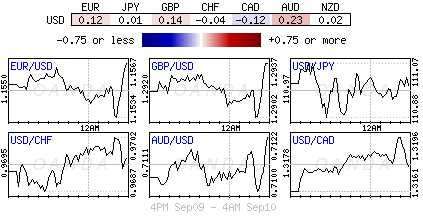

The ‘big’ dollar has extended last week’s gains, while U.S yields have come under pressure again. In commodities, oil has rebounded from its biggest weekly loss in two-months on speculation of a crude-supply shortage.

Elsewhere, the Swedish Krona (€10.4565) has edged higher after yesterday’s inconclusive general election – neither the Social Democrat-led nor the opposition Alliance bloc won enough votes to form a majority government.

On the central bank front, the Bank of England (BoE) and European Central Bank (ECB) will dominate proceedings this week (Sept 13), while the Fed will release its Beige Book in preparation for its FOMC meet later this month. Japan will publish its revised Q2 GDP.

On tap: U.K GDP & manufacturing production (Sept 10), U.S PPI & AUD employment (Sept 12), ECB & BoE monetary policy announcement (Sept 13) and U.S retail sales (Sept 14)

1. Stocks mixed results

A sell-off in Chinese stocks pushed a number of Asian bourses to a 14-month trough this morning as the market braces itself for a potential escalation in the Sino-U.S tariff row.

However, there were a few exceptions. In Japan, the Nikkei share average snapped a six-day losing streak after robust revised GDP data trumped trade war worries. The Nikkei share average rose +0.30%, while the broader Topix gained +0.20%.

Down-under, Aussie shares ended flat as health care, energy gains were offset by financials and materials losses. The S&P/ASX 200 index fell -0.03% at the close of trade, its eighth straight session of losses. The benchmark declined -0.3% on Friday. In S. Korea, stocks ended a three-day losing streak. The Kospi edged higher and was up +0.31%.

In Hong Kong, equities ended lower as the market braces for trade war escalation. The Hang Seng index ended down -1.3%, while the China Enterprises Index lost -1.2%.

In China, stocks ended lower on new tariff threats as Apple suppliers were hit by another Trump tweet. At the close, the Shanghai Composite Index was down -1.2%, while the blue-chip CSI300 index was down -1.45%.

In Europe, regional bourses trade higher, tracking U.S futures higher after a weaker session in Asia. In Particular, Italy is outperforming after Italian Finance Minister said that Italy would improve its budget balance.

U.S stocks are set to open deep in the ‘black’ (+0.4%).

Indices: Stoxx600 +0.3% at 374.90, FTSE +0.1% 7285, DAX 0% at 11961, CAC-40 +0.2% at 5260, IBEX-35 +0.6% at 9223, FTSE MIB +1.8% at 20816, SMI +0.8% at 8909, S&P 500 Futures +0.4%

2. Oil higher as U.S drilling stalls and Iranian sanctions bite

Oil prices have rallied overnight as data shows that U.S drilling stalled and as investors anticipated lower supply once new Iranian sanctions kick-in from November.

Brent crude oil has rallied +$1.09 a barrel, or +1.4%, to +$77.92, while U.S light crude is +7c higher at +$68.45.

Data from Baker Hughes on Friday showed that U.S drillers cut two oilrigs last week, bringing the total count to 860.

Note: The number of rigs drilling for oil in the U.S has stalled in the last four months, which suggests an increase in well productivity.

Outside the U.S, Iranian crude oil exports are declining ahead of a November deadline for the implementation of new U.S. sanctions.

Ahead of the U.S open, gold prices have fallen further on Fed rate hike views and as Sino-U.S trade war worries supports the ‘big’ dollar. Spot gold is down -0.2% at +$1,193.15, having declined -0.4% in Friday’s session. U.S gold futures fell -0.2% to +$1,198.60 an ounce.

3. BTP/Bund yields tighten

The gap between Italian and German 10-year borrowing costs is at its tightest in six-weeks, after Italy’s Economy Minister Giovanni Tria predicted yields would drop as the government laid out its budget for 2019.

Tria said yesterday that Italian bond yields would fall as the new government began to implement policies to boost the economy with prudent fiscal measures.

Note: Italian debt rallied this month after the government indicated that Italy’s upcoming budget would stay within E.U fiscal rules.

Italian yields are down -11 to -16 bps across the curve.

The BTP/BUND 10-year bond yield spread has tightened to +234.1 bps, its tightest level in six-weeks, and -55 bps below last week’s widest levels.

Elsewhere, the yield on 10-year Treasuries fell -1 bps to +2.93%.

4. Dollar in demand on pullbacks

Global trade tensions sees the USD in demand on pullbacks as President Trump tweeted that the U.S has more potential tariffs against China in the works if needed.

EUR/USD (€1.1583) off its worst level as Italian official continued their pacifying comments on the 2019 budget. Techies note that €1.1750 remains the key resistance for now.

On the emerging market front, currency pairs again remain on the defensive. USD/INR hit a fresh record high at $72.68 that prompted India to perform some verbal intervention. The rupee weakness is attributed to the release of the Q2 current account balance that recorded its widest deficit in five-years.

5. U.K economy accelerated in July

Data this morning showed that economic growth in the U.K accelerated in July, as warm weather powered consumer spending and construction.

According to the ONS, the U.K economy expanded +0.3% on month in July – a faster pace than the +0.1% monthly expansion recorded in June.

Note: Growth in the three-months through July was +0.6% compared with the previous three-months, or +2.4% on an annualized basis.

The data would suggest that the U.K economy is set for another quarter of growth despite little progress in Brexit negotiations.

Digging deeper, ONS data showed that the U.K’s goods trade deficit with the rest of the world narrowed in July, to +£10B from +£10.7B in June, as exports grew faster than imports.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.