Before the FX market gets to the highlight event of the week, tomorrow’s US employment number, investors have to deal with a few central bank rate announcements. Already this week an OECD report strongly mentions that “developed” nations should remain accommodating on fear that the already subdued growth rates in emerging economies could be weakened further if the strong outflow of capital from emerging economies persists. Any market movement over monetary policy announcements has more to do with the rhetoric around the communiqués than anything else. Investors should expect the BoE and ECB’s accompanying statements to be highly scrutinized well after this morning’s rate announcements.

Overnight the BoJ decided on a status quo, leaving their rate policy unchanged. Governor Kuroda continues to aim at increasing the monetary base outstanding by ¥60-70t annually. Policy members also decided not to touch the allocation of asset to be purchased. The unanimous vote decision suggests no material differences in views among the nine board members about their assessment of the economy and recent developments of financial markets.

Interestingly, the BoJ raised its overall economic assessment to “Japan’s economy is recovering moderately” in the communiqué. With the BoJ’s easing bias and while the Fed appears set to cut back on its asset purchases, interest rate differentials would suggest to favor the dollar over the yen. The pair has managed to punch through that psychological ¥100 barrier earlier this morning for the first time in six-weeks, keeping the median target rate of ¥105 for this year intact. Investors are waiting for the next steps from PM Abe to see how far he will go in his plan to reinvigorate the Japanese economy.

Not unlike the OECD slashing growth rates on the emerging economies, the IMF is also changing its tune on global economic assessment. The recent capital outflow events in emerging markets have forced the IMF into an about turn over its global economic assessment. Apparently the fund has dropped its view that “emerging economies were the dynamic engine of the world economy, instead noting that momentum is projected to come mainly from advanced economies, where output is expected to accelerate”.

The market expects the ECB to stick to its script of a dovish stance, with Draghi reiterating that rates (+0.75%) are expected to remain at “present or lower levels” for an extended period of time. In respect to the upbeat data recently from the Euro region, policy makers are likely to follow last month’s communiqué and acknowledge “some further improvement from low levels.” However, it will be prudent of the ECB to also “temper” any improvement by repeating, “risk to growth continues to be on the downside.” The ECB may provide a small upward revision to inflation and growth forecasts, nonetheless the regions recovery remains uncertain.

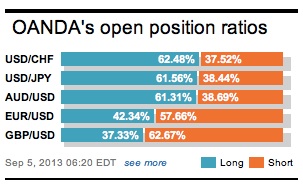

Euro uncertainty is likely to keep front-end Euro rates under pressure. Similar to the yen’s stance, interest rate differentials will play a bigger positional part for the EUR. Investors seem more comfortable being tactically bearish on the 17-member single currency, expecting the currency to move towards the bottom of its recent range in the 1.28’s. Combined with the possibility that the Fed could begin to “taper” in a matter of week’s favors the dollar.

The rookie BoE governor Carney is considered the one in the “hot seat.” His hands are currently tied somewhat, making today’s MPC meeting more of a non-event in terms of rate announcements (+0.5%). When it comes to rates, there is limited room for manoeuver. Recent stellar UK data, like the PMI’s reporting at the fastest pace in six-years, makes Carney’s forward guidance of low rates very difficult to maintain. This potentially will push QE or any rate moves off the table in the short term. A dovish BoE and a potential tapering scene in the US would imply that GBP, similar to the EUR, is likely to remain vulnerable ‘left-hand-side’ short term.

The market will not get carried away with rate announcements. Dealers and investors would prefer to keep their powder dry ahead of tomorrows US employment data. No one wants to be caught in the twilight zone ahead of the granddaddy of fundamental releases. Assuming the above rate scenario occurs and investors favor the interest rate differential dollar, its rise, as ever, will not be in a straight line. The concerns over a broader military confrontation in the Middle East could be seen as the main factor to drive cash towards some of the stellar safer-haven assets and currencies like JPY and CHF and commodities like bullion.

Other Links:

Some FX Half-Time Results So Far This Week

Dean Popplewell, Director of Currency Analysis and Research @ OANDA MarketPulseFX

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.