It’s been a mixed start to trading on Friday, with PMI data from euro area offering some cause for optimism while the numbers coming from the U.K. provided a much more pessimistic outlook for the manufacturing and services sectors.

The pound has come under some pressure on the back of those PMI figures, down around half of one percent against the dollar on the day and trading just above 1.31. A break through this level could see the pair test the lows following the Brexit vote, just below 1.28 earlier this month.

Source – OANDA fxTrade Platform

It wasn’t exactly a big surprise to see confidence in both sectors take a hit following the surprise Brexit vote but what was a concern was the size of the hit to the services sector, the main engine of growth for the U.K. economy. Both PMI readings fell into contraction territory, which was expected, but services fell heavily, back to 47.4 from 52.3 in June, which doesn’t bode well for the economic outlook in the coming quarters. If we continue to see these kinds of figures in the coming months, the economy could be headed for recession before the year is out.

USDJPY and JPY Crosses. Storm Clouds Gathering….

The eurozone figures offered a little more reason for optimism, falling slightly from June but not very much and in fact, the numbers coming from France actually improved slightly. It’s worth noting that these numbers can be quite volatile and therefore in isolation don’t necessarily offer an accurate insight into the outlook but if they are a sign of things to come then the region may be more resilient to Brexit than was thought.

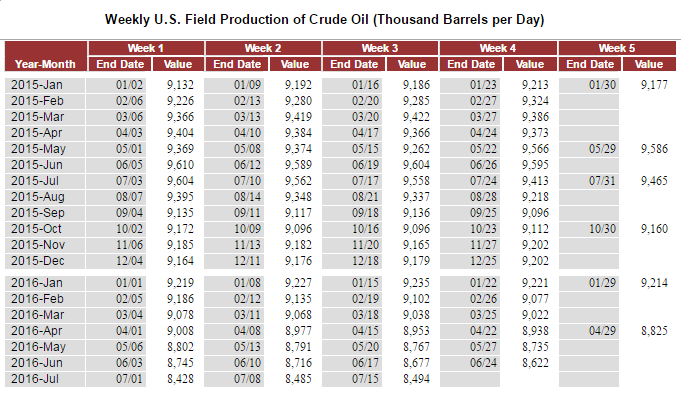

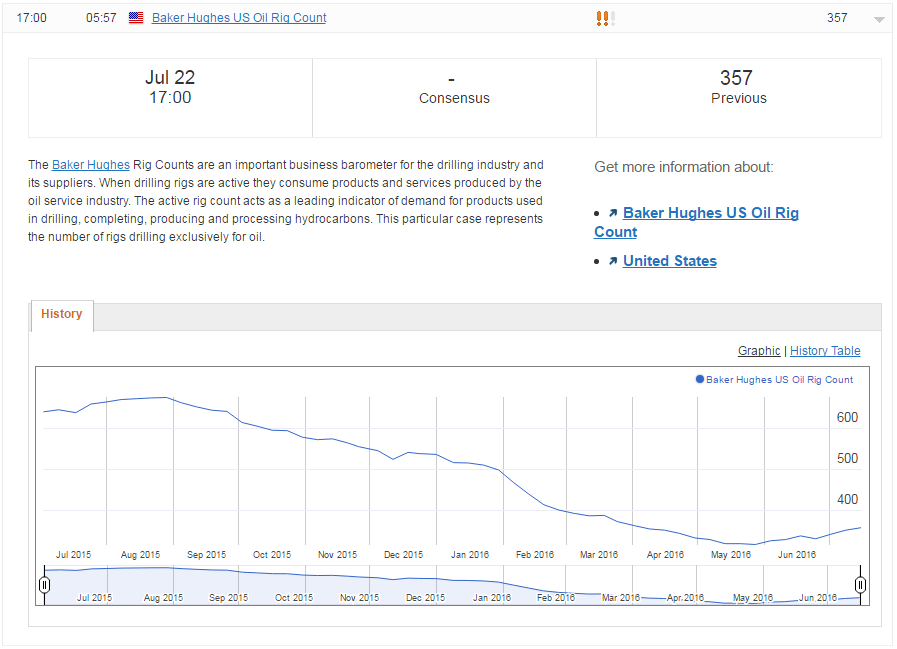

The U.S. session is looking a little quieter, with the focus once again falling on earnings season as another ten S&P 500 companies report on the second quarter, including American Airlines and General Electric. We’ll also get the latest manufacturing PMI data from the U.S. which is expected to rise slightly to 51.6 and the Baker Hughes U.S. oil rig count. The number of oil rigs in the U.S. has been creeping higher in the background since the end of May which could lead to a pickup in output after more than a year of declines.

Source – EIA Weekly U.S. Field Production of Crude Oil Data

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.