European markets are expected to open lower on Tuesday, tracking similar losses in the U.S. and Asia overnight.

We saw another sell-off in oil on Monday which may have contributed to the losses in equity markets but I’m not convinced at this stage that this was the main driver, given that the relationship has weakened somewhat over the last couple of weeks. We are seeing U.S. indices trading at multi-month highs while in Europe we’ve been in consolidation mode for almost a month, which probably better explains these small losses.

Oil is likely to remain volatile though as the prospect of a coordinated production freeze becomes increasingly less likely. The freeze could have been a first big step towards an agreement to cut production among all major oil producers but it would appear we’re some way from this. In the absence of either though, oil could find itself heading back towards its January lows.

The Nikkei is coming under some serious pressure overnight as the appreciation in the yen continues weigh heavily on the index. With the yen now trading back below 1.11 against the dollar and on course to test last month’s lows, it will be interesting to see if talk of intervention begins to surface again. This has been speculated on a lot recently and you have to wonder how much appreciation Japanese official will tolerate before they’re forced to act. This 1.11 region was touted at times last month but as of yet, there is no sign that this level is being defended this time around.

The Reserve Bank of Australia opted to leave its interest rate unchanged today, as expected, while acknowledging that its currency has also appreciated somewhat, recently. While it acknowledged that this may partially reflect similar gains in commodity prices, it’s clear that any further gains could make it uncomfortable, highlighting that it could complicate economic adjustment. There is clearly potential here for further rate cuts down the road but for now, the RBA is clearly happy to just monitor the situation. The Aussie dollar spiked shortly after the announcement but has since reversed most of these gains to trade back near pre-announcement levels.

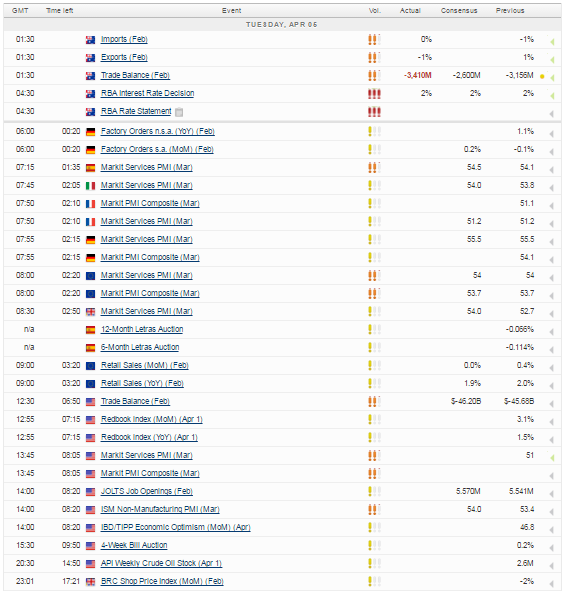

Still to come today we have plenty of economic data throughout the European and U.S. sessions. We’ve got services PMIs from the eurozone and U.K. throughout the morning, as well as retail sales data from the former shortly after. This afternoon we’ll get services and non-manufacturing PMIs from the U.S. as well as JOLTS job openings data.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.