US Futures Drop as EU Proposes Counter-Measures

It’s been a rocky start to trading at the start of the week, as the prospect of a trade war becomes ever more real.

Tariffs are likely to be the main topic of conversation at the G20 meeting at the start of the week after the European Union release details of counter-measures against Donald Trump’s steel and aluminium tariffs. The list totalled around €6.4 billion and will be intended to dissuade Trump from implementing tariffs on the EU, although given what’s been said previously by the US President, further counter-tariffs could be more likely. The question is whether the measures announced by the EU are sufficiently targeted so as to hurt the Republicans in the mid-term elections later this year.

Despite what he says, I’m not sure that a trade war is what Trump actually wants from these tariffs or that he’ll find much support for one within his party. I think the measures were intended to bring certain countries back to the negotiating table and intensify NAFTA negotiations. As yet, it appears other countries are in no mood to be pushed around and if Trump insists on following through on his threats, markets may react more negatively that we’ve seen so far.

DAX Down Sharply as European Tech Stocks Slide

GBP Rallies on Brexit Transition Deal Hopes

The pound is up around one percent against the dollar, euro and yen this morning after it was confirmed that a deal on the transition had been agreed ahead of the EU leaders summit later in the week. While the issue of the Northern Ireland border hasn’t been fully agreed, a backstop solution was so as to avoid a hard border, as was the case in December.

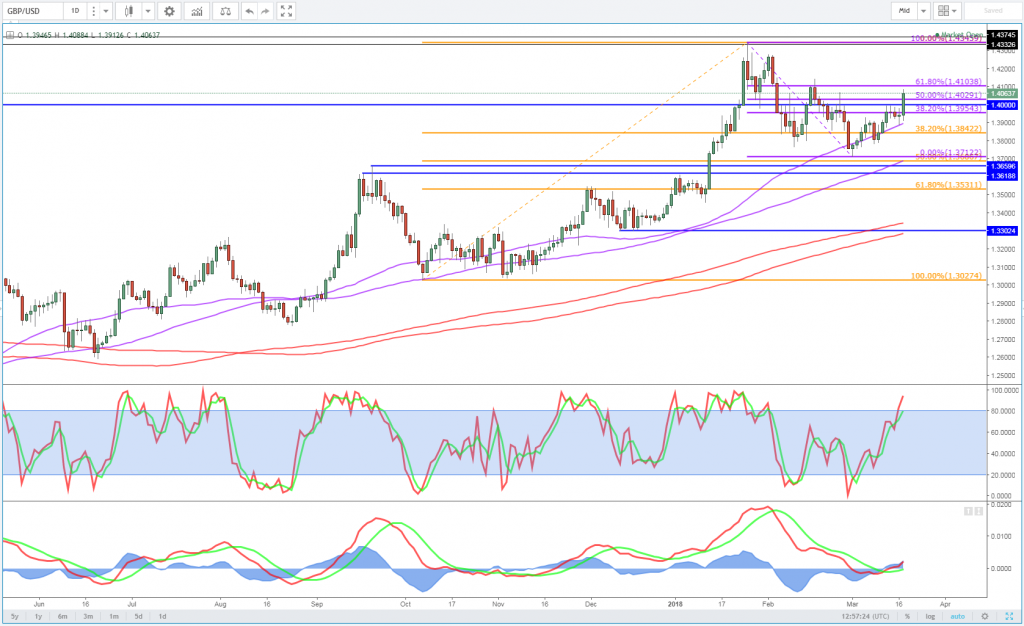

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

The pound initially rallied hours before the announcement as speculation grew that a deal announcement was imminent but that didn’t stop the currency having another burst higher after it was confirmed. The euro also benefited from the announcement, albeit to a lesser degree as it gives investors more hope that a mutually beneficial Brexit agreement can be reached in the months ahead and a cliff-edge scenario avoided.

Expect the Fed to Dial up on Rates

Fed, BoE and UK Data in Focus This Week

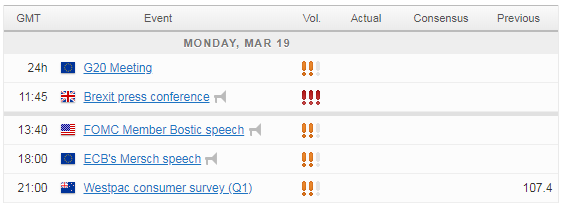

There may also be an element of caution ahead of another busy week for financial markets. Monday is a little quiet by comparison to the rest of the week, with the Federal Reserve poised to raise interest rates and release new economic projections on Wednesday. The Bank of England will meet on Thursday and while no rate hike is expected from them, markets are expecting at least one this year, with May being well priced in. If that’s to materialise, you would expect some quite strong hints this Thursday.

The UK will be a primary focus for many investors this week, with inflation, retail sales and labour market data also being released. This comes on top of Brexit talk and the ongoing dispute with Russia over the poisoning of an ex-spy in Salisbury a couple of weeks ago. Russia has denied any involvement despite the US, France and Germany joining the UK in accusing the country of carrying out the attack.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.