We’re seeing mild gains in the FTSE in what is otherwise a mixed European session this morning. US futures are pointing a little higher ahead of the open, with little direction coming from across the pond.

FTSE Stabilises as Election Uncertainty Weighs on Sentiment

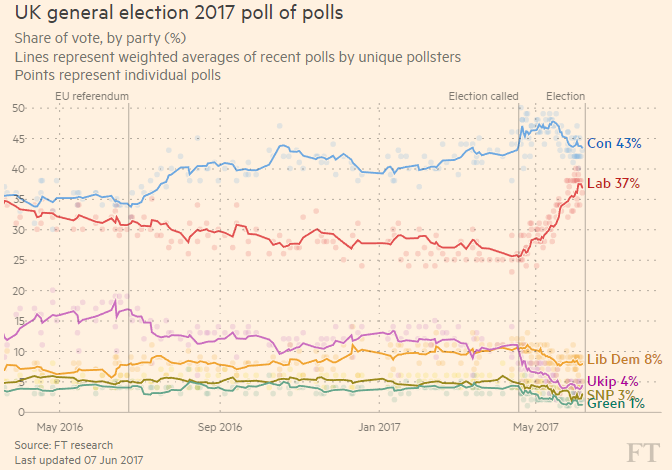

The UK index has stabilised in the weeks leading up to the election, with the sudden uncertainty around the outcome appearing to be contributing to the moves. We’ve seen a similar situation in sterling, which after coming off its highs as the polls showed the Conservatives strong majority being possibly wiped out, has since entered a period of relative stability. I don’t think this is helped by the polls with some indicating that the Conservatives have lost their majority altogether and others claiming its very much intact.

This should make for some volatile trade on Thursday evening as the exit polls start to come out. Should the exit polls suggest we’re headed for a hung parliament then the knee jerk reaction could be fierce in both the pound and the FTSE. Once this passes then the index could benefit from the weakness in the currency, as it has since the Brexit referendum. The question though is how long this will take. The knee jerk reaction in the FTSE didn’t last long after the referendum and the reaction to Trump in the US was much shorter again.

Dollar Drifts ahead of Super Thursday

With the last day of campaigning underway and there being little on the economic calendar, attention will likely remain on the UK today. The polls suggest that the Conservatives maintain a six or seven point lead which should be enough to secure a majority, but one that is far smaller than was expected when the election was called. This would come as a relief to the Conservatives and avoid the hung parliament scenario that may be worst case scenario for markets.

Source – FT Poll of Polls

EUR Tumbles on Reports of Lower Inflation Forecasts in Draft Projection

The euro has come off this morning after reports of a draft ECB staff projection which showed growth forecasts being revised higher and inflation lower through 2019. Should this be the case, it would support the need for monetary policy to remain very accommodative and either delay tapering or at least slow the pace of it. The dovish nature of this has hit the euro sending it back towards 1.12 against the dollar and below 0.87 against the pound. Should this be rejected, I would expect the moves to quickly reverse.

OANDA fxTrade Advanced Charting Platform

Slumpflation and Uncertainty Push Oil and Gold Higher

EIA Inventories Eyed as Oil Remains Under Pressure

The only notable data to come today is EIA crude oil inventories which follow an API release on Tuesday that reported a drawdown of 4.62 million barrels. With oil already under pressure as traders appear to question the suitability of the output deal and the latest geopolitical issues in the region weigh, it will be interesting to see whether another large drawdown will offer any support. Having broken below $50 though, Brent continues to look vulnerable to further downside.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.