Earnings Season in Focus as Stocks Target New Highs

US futures are pointing to another higher open on Wall Street on Wednesday, as companies prepare to report on the third quarter at a time when indices are hitting fresh record highs on an almost daily basis.

Companies started reporting third quarter results last week and while the number has picked up this week, it will likely dominate more and more over the coming weeks. Coming on the back of impressive second quarter results and in a more positive global economic environment, expectations are quite high for Q3, even taking into account the detrimental impact of the hurricanes towards the end of the quarter.

USD/CAD – Canadian Dollar Quiet Ahead of Cdn. Manufacturing Sales

USD Rebound Continues on Prospect of Hawkish New Fed Chair

The dollar is trading higher again this morning as the possibility of a more hawkish Federal Reserve Chair succeeding Janet Yellen in February raises the prospect of more interest rate hikes next year. Market expectations for interest rates next year are already well below those of the central bank, should Yellen be replaced by someone of a more hawkish nature, the market could find itself well behind the curve.

We’ve seen something of a recovery in the greenback over the last month or so but even still, it’s not a million miles from its lows and has some way to go to pare the substantial losses suffered this year. A break and hold above 94 in the dollar index may signal such a correction, which may be well supported into the end of the year should a more hawkish Chair appointment be announced and Congress make progress on healthcare and, more importantly, tax reform.

Source – Thomson Reuters Eikon

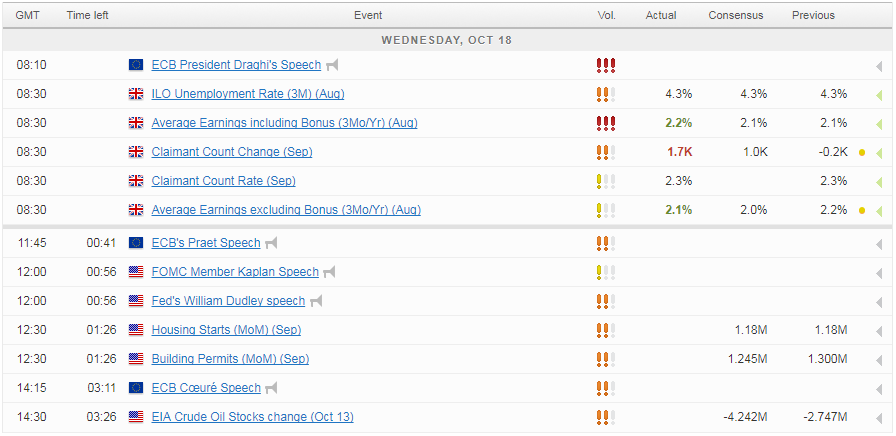

In the meantime it’s over to William Dudley and Robert Kaplan to provide an update on where the central bank stands on interest rates. While the Fed may have signalled an intention to raise interest rates once more this year and three times next, a number of policy makers have since expressed concern at the lack of inflation, something that also came across in the minutes from the meeting. Kaplan is among those that has shown a willingness to be patient and it’s unlikely that recent data will have changed his views on this.

Equities Stall, Dollar Drifts as Markets Seek Catalyst

Oil Higher on Inventory Report But Will EIA Back Up the Numbers?

Another highlight on Wednesday will be crude inventory numbers from EIA, which come after API reported a significant drawdown on Tuesday of 7.13 million barrels. Oil has been on another impressive run as of late, supported by higher global demand, a rebalancing of the market and more recently, supply disruptions in Iraq. A similar drawdown today may provide another boost but given the moves we’ve seen since the summer, I do wonder how much higher we can go in the short-term.

While the primary driver in oil markets will continue to be the supply demand dynamics and how effective the re-balancing efforts are, it is worth noting that if, as highlighted above, we do see a dollar recovery into the end of the year, this could weigh slightly on commodities as they are priced in dollars.

OANDA fxTrade Advanced Charting Platform

UK Jobs Data Doesn’t Change Interest Rate Expectations

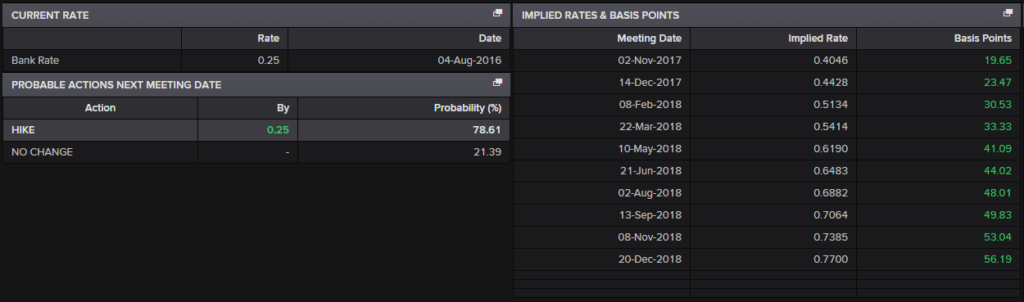

This week’s economic data from the UK was seen as being potentially influential when it comes to upcoming votes on interest rates, but as yet it appears the numbers have done little to affect expectations. With inflation and unemployment coming in line with expectations and wage growth only marginally – 0.1% – better, it seems traders are still convinced that a rate hike this year will happen, even if policy makers appear less sure.

People may be inclined to point to the improvement in wages as a sign of tightness in the labor market but there is little evidence that this is the case. It’s also worth noting that wage growth is coming from a low base and in real terms, it remains negative. This is one of the conundrums facing policy makers and the reason why comments yesterday from Sir David Ramsden and Silvana Tenreyro weren’t those of two policy makers convinced that raising interest rates is the correct move. Even Governor Mark Carney didn’t sound confident during his testimony before the Treasury Select Committee.

Still, if a majority of the Monetary Policy Committee were in favour of raising rates this year at the last meeting, then the data we’ve seen so far this week will likely not discourage them. There are still many people that believe it’s the wrong decision and data may still result in the decision being delayed but markets are still heavily pricing it in.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.