Trade War Buys Time For Europe

European markets are off to a decent start on Tuesday, possibly aided by reports that tariffs on EU autos by the US will be delayed for six months.

Source – Thomson Reuters Eikon

After everything we’ve witnessed last week, Trump’s denial will no doubt come sharpish, but until then investors are pleased. It would make sense to delay starting another major trade war until you’ve at least de-escalated another but then Trump doesn’t care much for what many people deem sensible.

Sterling brushes jobs data aside, focus on Farage olive branch

The pound is paring gains on Tuesday after receiving an unlikely boost from no-deal Brexit advocate and leader of the Brexit Party, Nigel Farage. In deciding not to run candidates in the 317 seats the Conservatives currently occupy, it is clearly a huge boost for Boris and his chances of getting his deal over the line.

That still leaves the issue of the seats that they don’t currently occupy that they would have stood a strong chance in that may still be split between the two parties, unintentionally handing victory to an anti-Brexit candidate. I don’t think we’ve seen the last of the deal making from those Brexit supporting parties, this may well just be Farage extending an olive branch in the hope that Boris makes the alliance less unilateral and more formal.

The jobs data this morning, much like the GDP data on Monday, was brushed aside by traders more focused on the outcome of the election and what it means for Brexit. It’s unlikely this week’s data would have any impact on the election outcome although a recession and rising unemployment would not have helped the Conservatives and would have been an unwelcome distraction.

Gold settles after tumbling through support

Gold bulls put up quite a fight over the last month and a half but they may now finally be conceding. Stops appear to have fallen just below $1,460, with fresh support now being found around $1,450. This may just be the beginning though with the big test for the yellow metal not coming until around $1,400. Still, $1,440-1,450 may put up a fight for now.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil steady in the middle of its range

Oil prices are steadying again right in the middle of the range it’s traded in since earlier this summer. This will be welcome for producers that may have been fretting this time last month when prices were hovering around their summer lows and threatening to drop further.

Flickers of hope for a partial trade agreement between the US and China next month have naturally aided the recovery but it’s not signed and sealed yet and Trump’s latest comments don’t suggest it’s that close. Of course, traders are prone to giving a little too much credence to the constant newsflow we get on these matters.

Brent Daily Chart

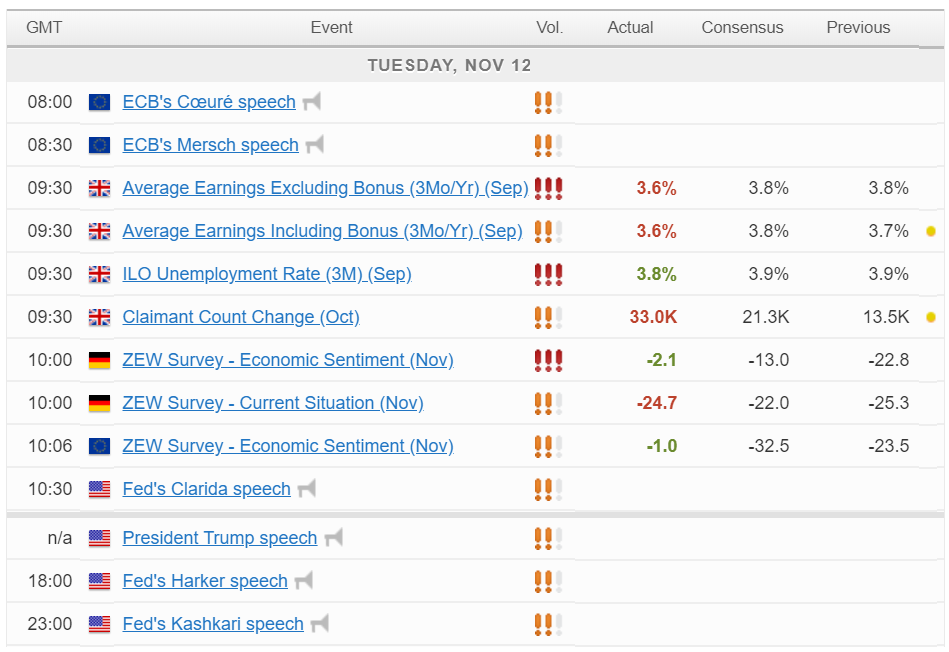

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.