Investors happy to see the back of October

It may have been a horrifying month for investors but a strong session in the US and Asia overnight could see it end on a less frightening note and even send us into November feeling a little less gloomy.

October has well and truly lived up to its chilling reputation, with stock markets around the globe suffering one of their worst months in recent memory. It’s been a wild ride for investors and there is no guarantee it’s over yet. Markets may have recovered their early losses and some indices may even be in the green for the week but volatility has not eased and that’s a concern.

Anxiety in still extremely evident in the markets and the next week is unlikely to calm that, with the jobs report, Fed meeting and midterms in the US only adding to the uncertainty. European stocks are expected to open well in the green on Wednesday but as we’ve seen recently, investor sentiment can quickly turn and those gains wiped out. I think there’s a few more scares to come before things settle down.

Equities push higher despite weaker China data

China sees gains despite weak PMIs

Chinese markets performed well overnight while the yuan continued to flirt with the seven handle against the dollar. This is seen by many as being a psychologically important level for the currencies, a break of which could propel it much further, potentially causing further tensions between the two countries. The central bank has been actively supporting the currency as it comes under pressure from tariffs in the hope of avoiding a scenario whereby rapid depreciation triggers outflows of capital from the country.

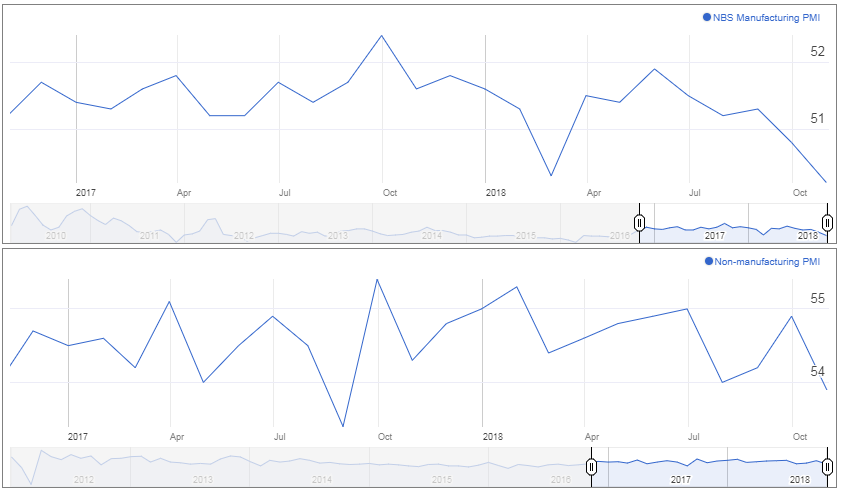

The gains in the markets came despite some weaker survey data from the country, with both the official manufacturing and non-manufacturing PMIs falling short of expectations. The former barely stayed in growth territory in a further sign of the impact tariffs are having on firms outlook for the economy.

China PMIs

Daily Markets Broadcast 2018-10-31

Gold lower on improved risk appetite, Oil traders shrug off inventory build

Gold continues to edge lower as risk appetite improves, with the yellow metal being hit by the double whammy of lost safe haven appeal and a stronger US dollar. The dollar index has risen to its highest level in more than an year on the expectations of further rate hikes in the US as the economy continues to perform at a level most Western allies could only dream of.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil is also reaping the benefits of returning risk appetite, etching out modest gains on the day so far. This comes despite API reporting another significant increase in stocks on Tuesday, something that was largely shrugged off by investors at the time. I wonder whether they’ll be quite so relaxed if EIA report a similar number later on today.

Oil (WTI and Brent) Daily Chart

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.