Markets higher ahead of ECB

A modestly positive start to European trade on Wednesday, as investors await tomorrow’s interest rate announcement from the ECB.

Source – Thomson Reuters Eikon

For all the fury around prorogation and the anti-democratic means to which it is being used, it has at least returned some peace and quiet to Westminster. That won’t help the UK when it comes to 31 October if Boris Johnson finds a way to circumvent Parliament’s legislation, forcing him to go cap in hand to Brussels, but it does have its upside.

It’s also shifted the focus to mainland Europe, where we’re awaiting an interest rate decision on Thursday that will see Draghi go out swinging. The ECB President is to be replaced in November by former IMF head Christine Lagarde and while he may have one time hoped his handover will coincide with a return to interest rate hikes, the opposite has turned out to be true.

Investors are expecting the full Draghi bazooka at his penultimate meeting, something to complete the highlight reel from a remarkable eight years. I wonder whether investors have positioned themselves to be disappointed, to unleash such a stimulus program just before the handover seems a little odd but some measures at least are highly likely.

Sign up for our next webinar below

Gold finds support again around $1,480

Gold prices continue to look a little vulnerable in the near-term, having fallen back towards $1,480 over the last week as risk appetite has improved in the markets. While the near-term prospects arguably look a little dim, with more stimulus coming from the ECB and Fed over the next week, the longer term still looks bullish. If support holds then $1,530 becomes key as a major area of resistance to the upside. A failure to break above here could set us up for another assault on $1,480.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil slips on Bolton sacking

The sacking of Trump’s National Security Advisor John Bolton had an immediate impact on oil prices on Tuesday. Bolton was seen as the most hawkish member of Trump’s team and the risk of an attack on Iran is now perceived to be much reduced. Time will tell whether this leads to a meeting between Trump and Rouhani that could really de-escalate the situation and see sanctions lifted but this is an important first step.

The decline in oil prices didn’t last long though and was reversed later in the session as API reported a larger than expected drawdown. If confirmed by EIA, it would be the fourth consecutive week of declines.

Brent Daily Chart

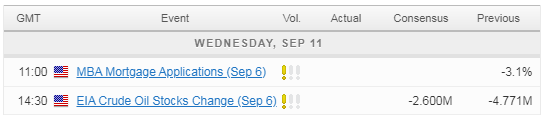

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.