Puigdemont Wants to Delay Independence Declaration

European equity markets are expected to open a little higher on Wednesday, with Spain’s IBEX a strong outperformer after Catalan leader Carles Puigdemont adopted a softer stance on independence on Tuesday.

While Puigdemont remained clear that they had been given a mandate for independence by the Catalan people, his call for talks in order to find a peaceful resolution was the much preferred option at this stage. A declaration of independence on Tuesday could have led to a chain of events that made the situation much worse and seen Puigdemont arrested, likely leading to more unrest.

Tax Reform doubts weigh on the Dollar

It’s now over to Madrid to decide how it is going to handle the situation, starting with whether it will agree to hold talks with the Catalan leadership on the issue. Outside mediation has been rejected by numerous officials including French President Emmanuel Macron who claimed Madrid can handle the situation. While a softer approach has boosted markets in the near-term is a positive, there remains a strong chance that the situation deteriorates quickly again if Madrid rejects talks and the Catalans are backed into a corner and forced to declare, an outcome that doesn’t seem entirely unlikely given Madrid’s handling of the situation so far.

Developments in Spain are likely to remain the key focal point from a European perspective this morning in the absence of any notable scheduled economic events. The week as a whole is going to be a little quiet on this front, with the only notable event being ECB President Mario Draghi’s appearance at the World Bank and IMF event in Washington on Thursday.

Fed Minutes and Speeches Make up US Schedule

The US is also in for a quieter week when it comes to economic data but with third quarter earnings season getting underway – including results from Delta and Blackrock today and JP Morgan and Citigroup tomorrow – there should be no shortage of newsflow.

USD/CAD Canadian Dollar Higher Despite Disappointing Housing Data

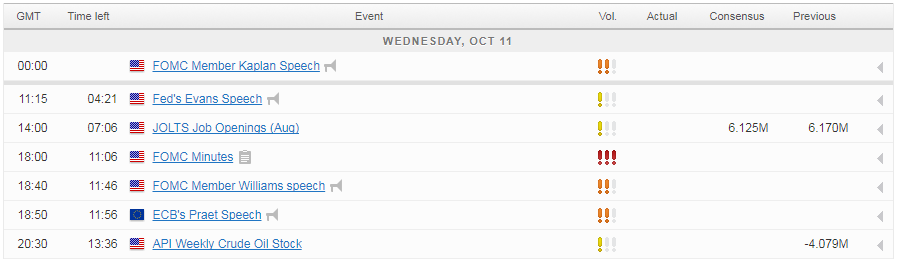

The release of the FOMC minutes this evening is today’s key event, with traders looking for further insight into the Fed’s interest rate plans. The dot plot from the last meeting made it clear that another rate hike this year and three more next year is still expected from within the committee but remarks since then from individuals not being overly convincing and a new Chair possibly taking over early next year, a huge amount of uncertainty remains.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.