Stocks opened slightly higher as China begun purchasing soybeans from the US and is expected to buy more. Positive comments also came from the China Commerce Ministry (MOFCOM) on improving communications on trade. The recent string of headlines has been fairly optimistic on US-China trade relations and supportive for stocks and negative for risk currencies, such as the Japanese yen. Wednesday’s rally came from the Wall Street Journal report that the “Made in China 2025” may be replaced. A friendlier industrial policy to foreign business is a key goal from the Trump administration. Progress has been made since the Xi-Trump meeting, but are nowhere near being over.

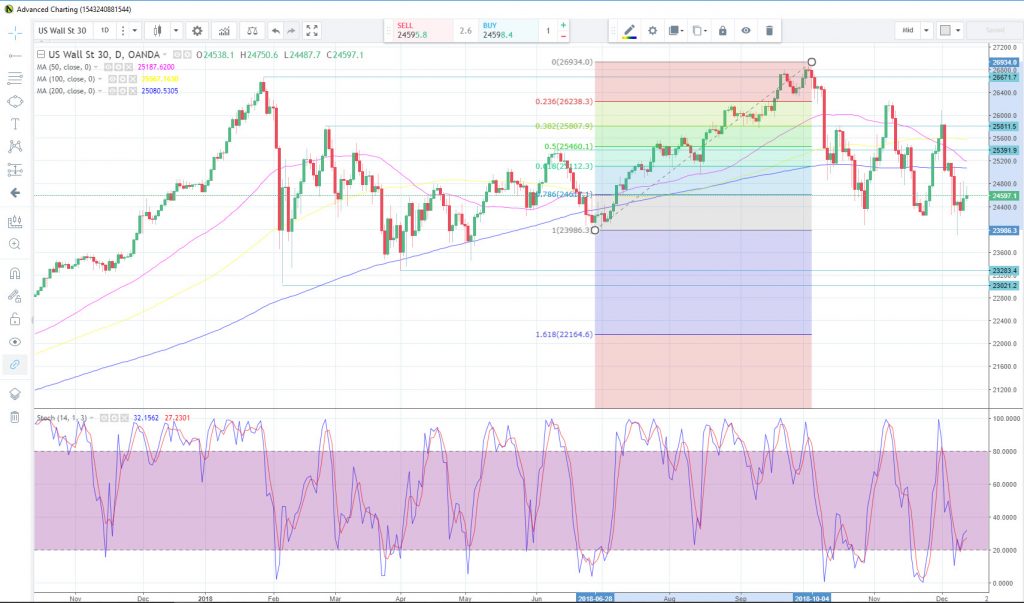

Despite the strong rebound from the December 10th low, price is struggling to muster up a strong rally. Price action on the Dow Jones Industrial Daily Chart is also showing that 24,800 remains initial resistance. Traders are also paying close attention, to see if we will see a death cross pattern. This technical market pattern occurs when the 50-day Simple Moving Average (SMA) falls below the 200-day SMA. The last death cross pattern occurred on January 2016 but did not provide a major move lower. We did see weakness for a couple of weeks, but shortly after a strong bullish reversal.

As stocks try to finish year on a positive note and above the 24,375 level, thin conditions will likely provide choppy price action. To the upside, 25,100 remains critical resistance, followed by 25,600. To the downside, the December 10th low at 23,894 is important support. Deeper support could come from the 23,200 level.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.