Tuesday March 12: Five things the markets are talking about

Global equities have extended yesterday’s gains, along with U.S futures, as the broad risk-on attitude across markets continues.

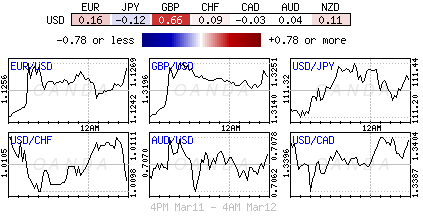

Treasuries prices are under pressure and the ‘big’ dollar has edged a tad lower, while sterling is climbing ahead of this afternoons crucial Brexit vote.

Markets are pricing in that today’s “meaningful” vote (03:00 pm EDT) on the Brexit withdrawal deal will either pass or fail by a small enough margin to keep the deal alive.

At a joint press conference yesterday evening, U.K PM Theresa May and EU Commission President Jean-Claude announced a revised Brexit deal.

Currently, the odds of the ‘new’ deal passing a Parliament vote have jumped to +30% from +10%. Expect trading sterling (£1.3204) and gilts to get messy, until we know where the U.K stands.

On tap: A slew of data from China this week (retail sales, investment, credit and industrial production) is expected to give the market a fresh insight on the impact of monetary stimulus. The BoJ will also meet to set policy. This morning, its U.S retail sales (0:8:30 am EDT).

1. Stocks get the green light

Global stocks continue to climb, after reassuring comments on the weekend from Fed Chair Powell and on signs that the U.S and China are nearing a trade deal.

In Japan, the Nikkei share average surged to a six-day high overnight, as a combination of a tech-led rally stateside Monday combined with a weaker yen led to broad-based buying. The Nikkei ended the day up +1.79%, its highest close since March 6. The broader Topix gained +1.52%.

Down-under, Aussie shares reversed course and edged lower overnight, as gains in mining and energy stocks were offset by losses in financials after the sector came under further political scrutiny. The S&P/ASX 200 index ended down -0.1%. The benchmark declined -0.4% on Monday. In S. Korea, the Kospi index rallied +0.89% after the European Commission agreed to changes in a Brexit deal. It’s the biggest daily gain since Feb. 20

In China and Hong Kong, equities edged higher as China and the U.S appear to edge closer to a trade deal but worries about domestic economic headwinds have capped gains. At the close, the Shanghai Composite index was up +1.1%, while the blue-chip CSI300 index was up +0.7%. In Hong Kong, the Hang Seng index was up +1.5%, while the Hang Seng China Enterprises index rose +1.7%.

In Europe, regional bourses trade mostly flat across the board. The FTSE 100 is underperforming on continued strength in the pound.

U.S stocks are set to open in the ‘black’ (+0.2%).

Indices: Stoxx600 +0.90% at 373.92, FTSE -0.22% at 7,115.25, DAX -0.03% at 11,540.37, CAC-40 +0.17% at 5,274.98, IBEX-35 +0.03% at 9,174.30, FTSE MIB -0.21% at 20,594.50, SMI +0.81% at 9,336.20, S&P 500 Futures +0.21%

2. Oil rises as Saudi deepens OPEC supply cuts, gold higher

Oil prices remain better bid, as Saudi Arabia appeared to deepen OPEC’s supply cuts aimed at tightening markets, although gains are being capped by the ongoing surge in U.S supply and worries over the global economy.

Brent crude futures are at +$66.82 per barrel, up +24c, or +0.4%, while U.S West Texas Intermediate (WTI) crude oil futures are at +$57.08 per barrel, up +29c, or +0.5%, from Monday’s close.

Oil prices have been receiving broad support in 2019 from supply cuts by OPEC aimed at tightening markets. Yesterday, Saudi Arabia announced further plans to cut its crude oil exports in April to below +7M bpd, while keeping its output “well below” +10M bpd. That compares to production of around +10.14M bpd last month.

Also supporting prices is the political and economic crisis in OPEC-member Venezuela. The lack of electricity is making it very difficult to pump and produce crude.

Despite the gains, markets are being held back by revisions to global growth by OECD and G7 central banks.

Note: OPEC meets in Vienna on April 17-18, with another gathering scheduled for June 25-26, to discuss supply policy.

Crude prices are also being supported by Baker Hughes’ latest weekly report showing the number of U.S rigs drilling for new oil production stateside fell by nine to 834.

This is the third consecutive week of declines as U.S oil producers trim their 2019 spending budgets. Nevertheless, because the overall U.S drilling level remains relatively high, the market still expects U.S crude output to rise above +13M bpd sooner than later.

Ahead of the U.S open, gold prices have rallied as the dollar weakened against the pound after the E.C accepted amendments to the UK’s Brexit deal, although gains are limited as the agreement also supported sentiment for riskier assets. Spot gold has rallied +0.1% to +$1,294.90 per ounce, while U.S gold futures added +0.3% to +$1,294.70 an ounce.

3. Brexit deal hopes push German Bund yields away from lows

Yields on Tier 1 eurozone government bonds have backed up on hopes that PM Theresa May could be close to securing approval for her Brexit deal dented demand for safe-haven assets.

Germany’s benchmark 10-year Bund yield has rallied +2.5 bps to +0.09% – moving away from its two-year lows hit last week in the wake of a “dovish” ECB.

It’s a similar story across the region with other highly rated sovereign yields also backing up +1-2 bps.

The yield on 10-year Treasuries has advanced +2 bps to +2.66%, the biggest rise in more than a week, while in the U.K, the 10-year Gilt yield has increased +6 bps to +1.235%, the biggest increase in almost two weeks.

4. Dollar playing second fiddle to Brexit

Sterling (£1.3214) has found support as markets are pricing in today’s meaningful vote on the U.K’s draft Brexit withdrawal deal will either pass or fail by a small enough margin to keep the deal alive. If the revised Brexit deal doesn’t pass through parliament, sterling is expected to fall, but the move would likely be capped, because the possibility of Article 50 being extended still leaves open the options of a “softer” Brexit.

EUR/USD (€1.1280) is being pushed up by the rising pound. However, the ‘single’ unit is not expected to rise significantly further because German industrial production data, due tomorrow, is expected to stay weak.

The Japanese yen has fallen -0.1% to ¥111.34, the largest fall in a week.

5. U.K economy rebounded in January

Data out of the U.K this morning showed that their economy rebounded in January after a weak December, keeping growth on an even path despite the ongoing political drama surrounding Brexit.

The ONS said the U.K economy grew at an annualized rate of +1.1% in the three months through January, up from a revised +0.9% in the three months through December. Growth in January alone was +0.5%, reversing a -0.4% contraction in December.

Digging deeper, the expansion was driven by healthy growth in the services sector, especially wholesale and retail trade, which offset a poor three months for industrial production and construction.

Note: Uncertainty over the country’s future ties weighed on investment last year, causing the economy to turn in its weakest annual performance in seven-years.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.