European stock markets are expected to open a little lower following a relatively mixed session in Asia overnight, as investors await a raft of data from Europe and the U.S. throughout the day while still having one eye on tomorrow’s U.S. jobs report.

It will be very interesting to see how investors respond to the economic data in the coming days as many of the central banks that have previously been very active, have given the impression that the coming months will be quite the opposite.

The ECB is unlikely to be keen to commit to further stimulus any time soon given that it only recently threw everything including the kitchen sink at the problem. The Federal Reserve on the other hand has recently halved its expected rate hikes this year and the message from Janet Yellen on Tuesday appeared to suggest that the next one is not imminent. The Bank of England has been inactive for some time and is expected to remain this way throughout this year, especially with the U.K. vote on E.U. membership coming in June, just to throw one more economic risk on the pile.

We’ll get inflation data from a number of eurozone countries throughout the early part of the session with the overall reading due around 10am in the U.K.. This is expected to show core inflation rising by 1% in March, up from 0.8% the month before. This is still well below the ECBs target of below but close to 2% but it will please the central bank to see it moving in the right direction, which will hopefully continue once the effects of its latest stimulus package take effect. That said, the stronger euro may offer some resistance to any upward price pressures after the ECBs stimulus was not successful in weakening the currency, in fact it has been on an upward trajectory ever since.

We’ll also get fourth quarter GDP data from the U.K. this morning which is expected to confirm that the country grew by 1.9%, year on year. This will be followed this afternoon by jobless claims and the Chicago PMI from the U.S. and a speech from the Fed’s William Dudley.

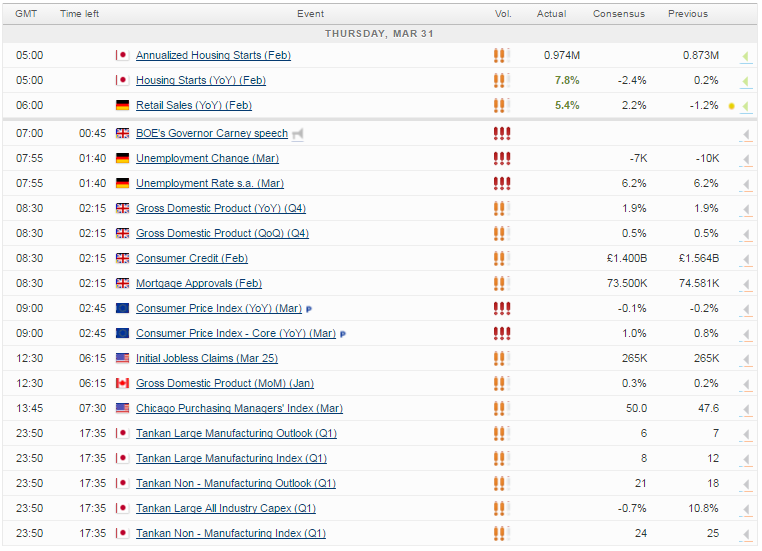

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.