Daily Markets Broadcast

2019-02-01

Wall Street extends rally on trade hopes

While there was no concrete deal announced, the mood coming out of the two-day US-China was positive, with US President Trump announcing he will meet with China Xi “in the near future” to finalise details.

US30USD Weekly Chart

-

January saw the US30 index post the biggest monthly gain since Oanda records began in 2003. A dovish Fed and hopes for progress in the US-China trade talks continue to support

-

The index looks poised for a weekly close above the 55-week moving average at 24,950 for the first time since the week of November 26

-

The US payroll report is due today and an add of 165k jobs is expected, lower than December’s 312k. Unemployment is expected to hold at 3.9%. The ISM manufacturing PMI is also due, with forecasts of a dip to 54.2 in January from 54.3 the previous month.

DE30EUR Daily Chart

-

It was a volatile session for the Germany30 index yesterday before closing slightly in the red. Despite the weaker close, the index recorded its first monthly advance in six months in January

-

The index remains confined between 100-day moving average resistance at 11,388 and 55-day moving average support at 11,026

-

Euro-zone consumer prices are expected to rise 1.4% y/y in January, according to the forecasts for today’s preliminary reading. That’s a slower pace than December’s +1.6%.

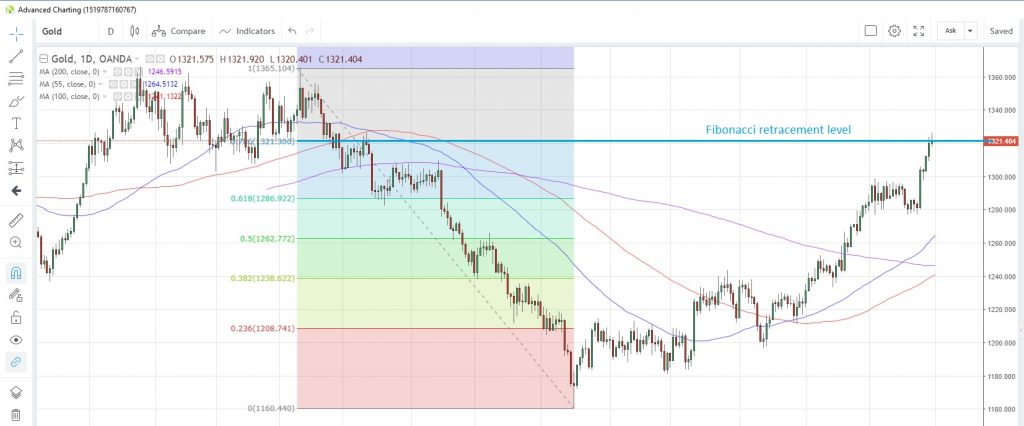

XAUUSD Daily Chart

-

Gold advanced versus the US dollar for the fourth consecutive month in January, bringing total gains from the October low to more than 12%. The metal touched the highest since April 26 yesterday

-

Gold is straddling the 78.6% Fibonacci retracement level of the April to August drop at 1,321.30

-

Gold spent most of January attempting to break above the psychological 1,300 level, which eventually fell on January 25. The metal is looking to consolidate and extend this move amid a broadly bearish outlook for the US dollar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.