Daily Markets Broadcast

2018-10-18

Wall Street lower as US yields rise post-FOMC minutes

US indices consolidated the previous day’s strong gains with a mild retracement. Minutes of the last FOMC minutes showed a hawkish bias, which pushed US yields back up and put pressure on stocks. Weaker oil prices also pressured energy counters. The UK100 index is still plagued with Brexit stalemate.

US30USD Daily Chart

-

The US30 eased off from one-week highs as FOMC minutes showed Fed officials were considering the need to push rates above the perceived long-run neutral level

-

The index stalled ahead of the 55-day moving average at 25,968. Support points are possible at the 100-day moving average (25,476) and 200-day average at 25,142

-

Yesterday’s release of housing starts data showed the sector is lagging behind, despite robust growth and higher wages, due to rising mortgage rates. Today sees October’s Philadelphia Fed index released, which is expected to ease back to 20.0 from 22.9

DE30EUR Daily Chart

-

The Germany30 index snapped a three-day rising streak yesterday, closing lower after touching the highest in a week

-

The index remains below the 55-day moving average at 12,238. This average has capped prices on a closing basis since end-August

-

Euro-zone Sep CPI data came in as expected. Today we see Germany’s wholesale prices, which are expected to rise 0.4% m/m

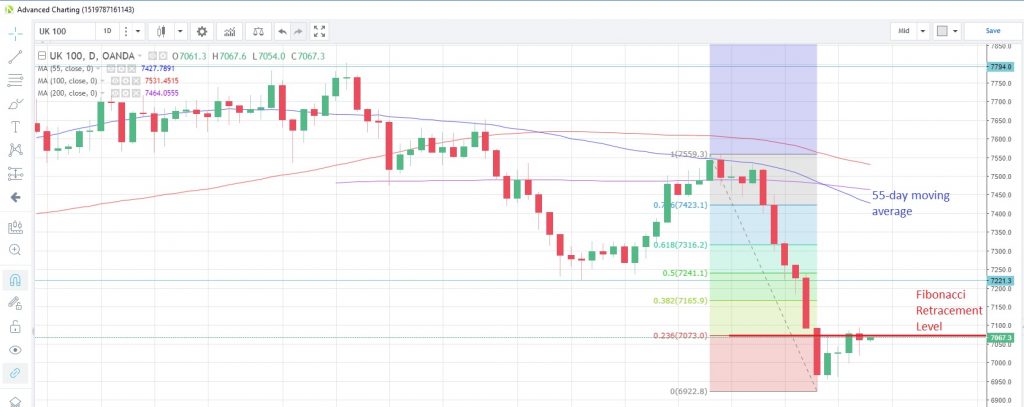

UK100GBP Daily Chart

-

The UK100 index closed lower for the first time in four days yesterday, weighed down by Brexit stalemate and unable to benefit from softer CPI numbers

-

The u-turn came near the 23.6% Fibonacci retracement level of the Sep27 to Oct11 decline. The 55-day moving average is at 7,428

-

Retail sales data for Sep is due today, seen falling 0.4% m/m after a 0.3% gain in Aug. This probably ties in with the softer CPI numbers yesterday. An above-forecast number could give the index a boost

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.