A less hawkish-sounding speech by Fed Chairman Powell at Jackson Hole pressured an already sliding dollar last week, and helped both metals and agricultural commodities to push higher. A more hopeful environment for US-China trade negotiations improved the outlook for oil, added to by concerns about the true impact of Iran sanctions and associated supply implications.

Energy

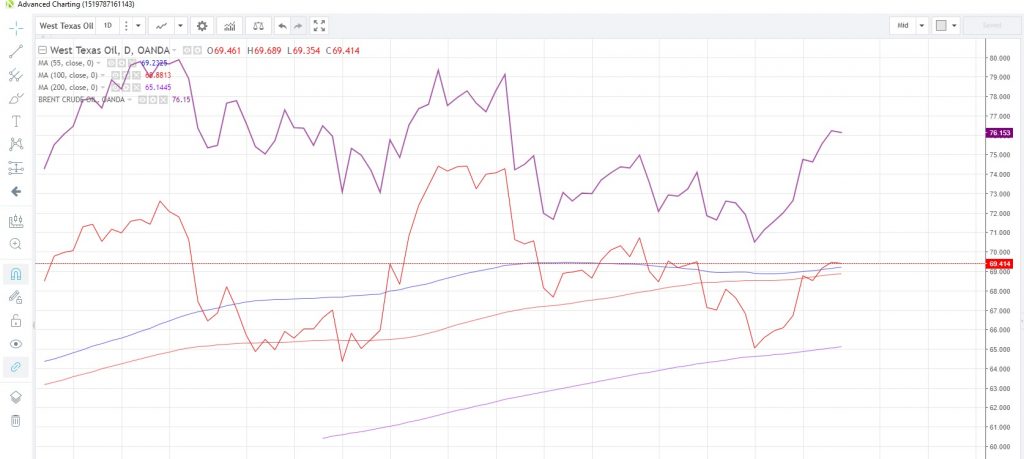

WTI CRUDE OIL has powered to its highest level since August 7, rising for eight out of the last nine sessions, after support at the 200-day moving average halted a slide which started early-July. A weaker US dollar helped boost prices and a possible inability of other OPEC producers to counter the drop off in Iran exports also helped, as sanctions start to bite. In addition to Iran concerns, the International Energy Agency warned Monday of supply disruptions from Venezuela, where an economic crisis is affecting output.

Tomorrow’s release of EIA crude stocks data is expected to show a small add of 0.46 million barrels to inventories after the previous week’s dramatic drawdown. The WTI/Brent spread has widened to 6.8, largest since June 21.

WTI/Brent Spread Daily Chart

Natural gas

Expectations of cooler weather in the US Northwest and anticipated higher production is keeping NATURAL GAS pressured this week. Prices have fallen as much as 3.2% in the past two days and are currently at 2.8790, just above the 55-day moving average at 2.8752, which has held since August 6.

China is building up its defenses against a harsh winter by adding new Liquefied Natural Gas terminals, increasing its import capacity by more than 19% from the start of last winter, Bloomberg reports.

Precious metals

GOLD continues to benefit from a weaker US dollar as the precious metal has advanced 4.5% from the low on August 16. In his speech at Jackson Hole last Friday, Fed Chairman Powell appeared to strike a more cautious note on the timeline for the series of Fed hikes, and this added downward pressure to the US dollar, whose rally since March had already seemed to run out of stream.

Speculative traders added to net short positions in the week to August 21, according to the latest CFTC data released Friday. Net shorts are now at 8,710 contracts, the highest since December 2001. Gold is currently trading at 1,208.89 after trading below the 1,200 mark for 10 days in the past two weeks.

SILVER also continues to edge higher, building a base above the 29-month low struck earlier this month. The metal has recovered to 14.8591 from 14.3375, a 3.6% gain. Moving average resistance can be found at the 55-day moving average at 15.6284. Speculative traders likewise added to net short positions, selling a net 5,022 contracts in the week to August 21, latest CFTC data shows.

PLATINUM is moving in tandem with other metals after the US and Mexico announced a bilateral trade pact that was being negotiated for months. This is easing tensions about a possible dent to global growth and hence demand for platinum. The commodity has edged up to 805.926, set for the third straight day of gains, and is targeting the 55-day moving average at 832.610.

PALLADIUM is trading at its highest level in 6-1/2 weeks as the US dollar slides. The metal touched 952.175 yesterday, that’s the highest since July 13. Speculative positioning is still net long, though this has been reduced to 982 contracts, the smallest net long position since December 2003.

Palladium Daily Chart

Base metals

COPPER markets continue to be plagued by potential supply disruptions. Producers in Chile narrowly avoided a labor strike last week, which threatened to shut down production at a couple of mines. Now it is the turn of Peru, where local landowners are blocking a major highway, accusing the China-owned operator of the Las Bambas mine of building the road illegally across land belonging to indigenous people. The road has been blockaded for almost a week now and is preventing copper shipments from the mine.

Copper appears to be struggling to breach the 2.70 mark to the upside, having failed to sustain any move above the level in the last three days. The commodity is currently at 2.6851.

Agriculturals

Freezing temperatures in Brazil is threatening to hurt WHEAT crops and the cold front is expected to head towards Argentina, possibly affecting crops there too. The news is not having much impact on prices as yet, with the wheat CFD trading at the lowest level in more than a month.

Wheat broke and closed below the 100-day moving average yesterday for the first time since July 16 and is now at 4.955 after touching 4.946 earlier today, the weakest since July 24. The next moving average support is the 200-day at 4.6644.

Data released last Friday showed SUGAR production in Brazil was down 21% from a year ago, and estimates are suggesting that the full-year’s crop could be below 28 million tons. There was also brisk buying of sugar by stockpilers and bulk consumers in India, which has helped lift local prices.

Sugar is up 3% today, poised for its biggest one-day gain since August 3, and is heading toward this month’s high of 0.10964 hit on the 6th. Support may be found at the August 22 low of 0.09814.

SOYBEANS failed to breach the 55-day moving average on a closing basis last week. Though the commodity traded to a high of 8.924 on August 20, the close was still below the moving average at 8.8049. Soybeans have since suffered five down days in the last six and hit 8.265 yesterday, the lowest since July 16.

The USDA announced that the first tranche of its farm aid program will be disbursed from September 4. It will make $4.7 billion in direct payments to coincide with the 2018 harvest. The bulk of the payments, $3.6 billion, will be made to soybean farmers to offset losses from the import tariffs imposed by China as part of the ongoing trade war.

CORN is again testing the 61.8% Fibonacci retracement level of the July 12 to August 8 rally at 3.434, which has held on a closing basis for the past four sessions, including today. A sustained breach of the level would bring the 78.6% retracement level at 3.367 in to play.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.