European equity markets are expected to open a little lower on Tuesday, tracking similar losses in Asia overnight but remaining firmly within this month’s relatively tight trading range.

Investors are very much in wait-and-see mode right now with the next month bringing two very notable risk events, the E.U. referendum in the U.K. and a possible rate hike from the Federal Reserve. Investors have been in denial about the potential for a summer rate hike for most of this year but appear to be coming around to the idea now that the Fed has firmed up its stance on the matter, insisting that June is very much live and a hike is warranted if the data continues to perform as it has. I think the market still has some way to go to completely buy into the idea though, something Janet Yellen could have a big say on this Friday.

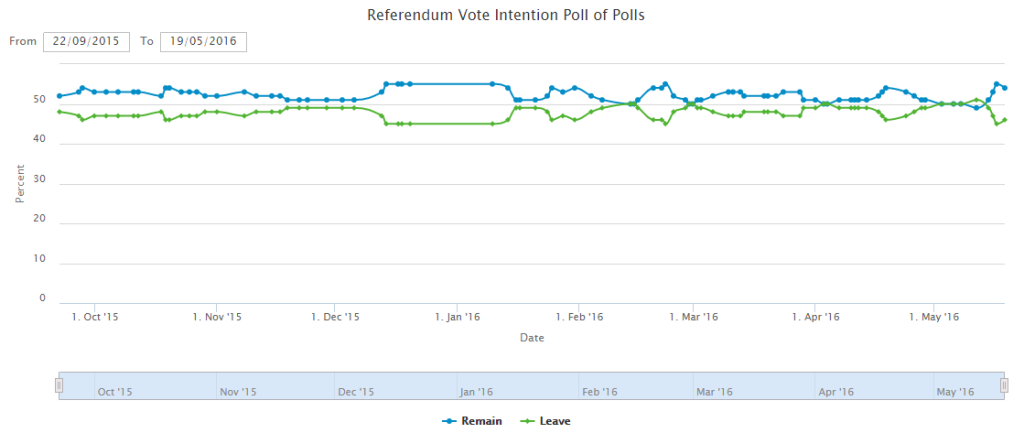

One of the things that could interfere with a June hike from the Fed and something that the markets clearly think will, is the U.K. referendum on E.U. membership which takes place just over a week after the FOMC meeting. As it stands, the polls suggest the “Remain” camp is in the lead but the size of the gap varies significantly dependent on the poll or implied odds you choose to follow. With just under a month to go, this is also likely to change a number of times before the vote takes place on 23 June, with both camps stepping up efforts to convince the still-large number of undecided voters.

Source – WhatUKThinks EU Referendum Poll of Polls

Bank of England Governor Mark Carney could have another say in this today, when he and other policy makers appear before the Treasury Select Committee to discuss the inflation report. The event is likely to focus primarily around the referendum, with the BoEs forecasts being based on the assumption that we remain in the E.U.. Carney has come in for some heavy criticism over his views on the economic impact of a Brexit in recent months which may make today’s appearance a little feisty and uncomfortable for him. That said, I don’t expect him to back down on this and instead reinforce his views on the near to medium term impact.

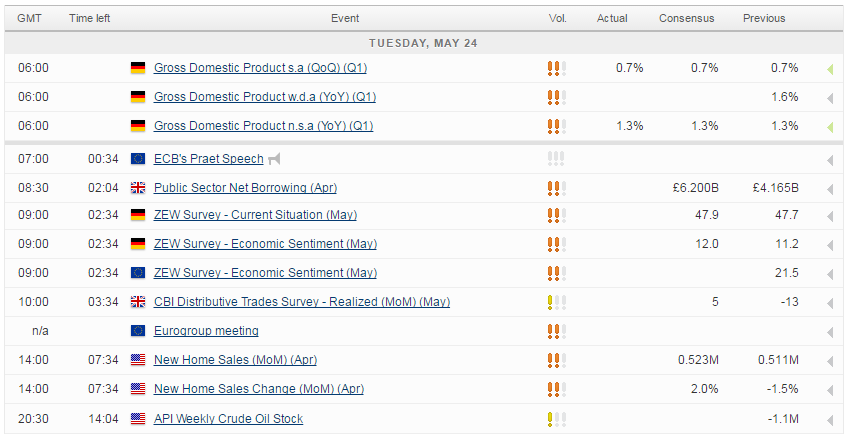

The eurogroup will also meet today, with Greece once again being top of the agenda. Greek lawmakers passed the latest demands through parliament over the weekend which included tax hikes in an attempt to satisfy its lenders and secure the next tranche of its bailout which is needs to repay IMF loans and ECB bonds maturing in July. The controversial topic of debt relief still hangs over these talks and makes an agreement all the more difficult, especially one that continues to involve the IMF.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.