The RBNZ releases property cooling measures setting up rate cuts and a lower NZD.

This morning, the Reserve Bank of New Zealand (RBNZ)has released a consultative paper, stating that it intends to enact new macro-prudential measures nationwide to mitigate systematic risks to bank from mortgage lending. In a nutshell, the main points are

1. No more than 5 percent of bank lending to residential property investors across New Zealand would be permitted with an LVR of greater than 60 percent (i.e. a deposit of less than 40 percent).

2. No more than 10 percent of lending to owner-occupiers across New Zealand would be permitted with an LVR of greater than 80 percent (i.e. a deposit of less than 20 percent).

3. Loans that are exempt from the existing LVR restrictions, including loans to construct new dwellings, would continue to be exempt.

Press release here. Press Release

Consultation Paper here. Consultation

The rules will come in in a very rapid six weeks on September the 1st.

By doing this the RBNZ is attempting to remove one of its main roadblocks monetary policy wise. Ie how to cut rates in a low inflation environment when the housing market is on fire. With a low print on CPI, yesterday and the RBNZ update on Thursday one expects that there will now be a serious talk from them vis-a-vis the level of the NZD and their intentions re interest rate cuts. It is hard to interpret it any other way then they will say the NZD is too high and that we can expect a cut at the August meeting and another one later in the year.

Certainly, that is what the street is thinking as NZD 2 year swaps make new lows this morning and the NZD falls 80 points to 7030. There is certainly no good news on the charts this morning for NZD.

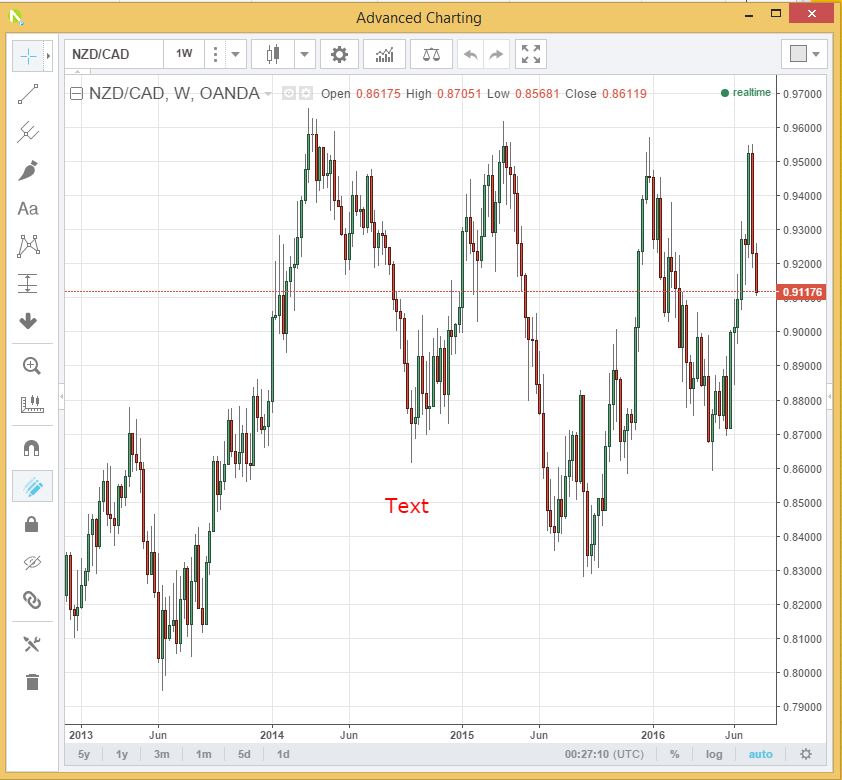

Our old friend NZD/CAD weekly. Neckline resistance held at 9530.

Support now at 9090.

NZD/USD weekly. Double top at 7305, 100 weeks moving average at 7115.

Support at the top of weekly cloud at 6917.

NZDJPY daily. Testing support here at 74.60. Next support 7410.

Resistance at 74.90 cloud base and the 100-day moving average.

AUDNZD daily. Goodness me what a rally this week! Resistance at 1.0800 100DMA and then cloud top and 200 DMA at 1.0840. Support at 1.0630

Support at 1.0630, bottom of the cloud.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.