The Swiss National Bank slowed the pace of its tightening cycle on Thursday, in line with market expectations but signaled there is more to come.

While most central banks would dream of 2.2% inflation right now, the SNB has made clear that there will be no complacency. Today’s hike likely doesn’t mark the end of its cycle, with another 25 basis points expected in September.

Having previously indicated that he believes the neutral rate is around 2%, Chair Thomas Jordan has effectively signaled to the markets that they won’t be done until at least this level is reached and today’s comments support that.

As did the forecasts, which assuming steady rates, had inflation remaining above 2% in two years’ time. In other words, more tightening will be necessary, alongside currency interventions, in order to get inflation back below 2%.

Despite some initial volatility, the Swiss franc is only a little lower on the day and not far from its pre-release levels. Against the dollar, it has been trending sideways for more than a month and today’s decision has so far failed to sway it one way or another.

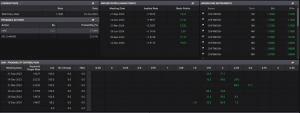

A move below 0.8850 could make things interesting, as could a move above 0.91, but with the price sitting almost in the middle of these two levels currently, we may have to wait a little longer yet.

Markets are pricing in a strong chance of another hike in the cycle while indicating a small chance that the central bank is done. There is still a long way to go in the global inflation fight and, if the last couple of years are anything to go by, there may be some more twists and turns to come.

USD/CHF Technical

For a look at all of today’s economic events, check out our economic calendar: www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.