- “Artificial Intelligence” (AI) equity-theme plays are the main contributor so far in the current bull market.

- Non-technology companies are now jumping into the AI-related bandwagon.

- The gap between current AI optimism and economic cyclical factors has widened.

The theme plays of “Artificial Intelligence” (AI) with its associated semiconductors chipmakers, and developers have been the main driver contributing to the ongoing bull run seen in some areas of the global equities space as well as in the US stock market, using the S&P 500 as a gauge since late October 2022.

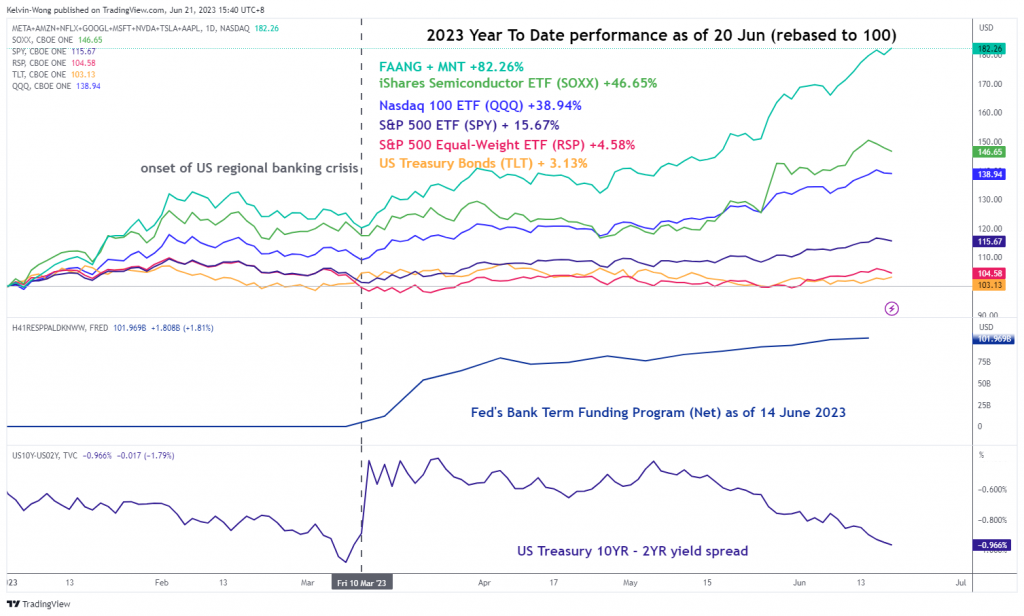

The US mega-cap technology group; Meta/Facebook, Apple, Amazon, Netflix, Alphabet/Google, Microsoft, Nvidia, and Tesla (FAANG + MNT) has significant business operations related to AI except for Netflix has notched a return of +82.26% year-to-date as of 20 June 2023 that surpassed the Nasdaq 100 (+38.94%), S&P 500 (+15.67%) and equal-weighted S&P 500 (+4.58%) by a wide margin over the same period.

Liquidity could be a major factor that supports the AI theme plays outperformance

Fig 1: 2023 YTD performance of FAANG + MNT versus the others with BTFP & UST 10-YR over 2-YR spread

(Source: TradingView, click to enlarge chart)

In addition, this AI-themed outperformance kickstarted “coincidently” after the onset of the regional US banking crisis that occurred on 10 March 2023 which led to the US Treasury and the Federal Reserve implementing some form of liquidity injection/backstop via a newly created Bank Term Funding Programme (BTFP).

Hence, it can be argued that its current magnificent outperformance can be more liquidity driven which may overshadow the realities of economic/fundamental factors which in turn could increase the speculative behaviour of market participants; FOMO (fear of missing out).

More firms are jumping onto the AI bandwagon

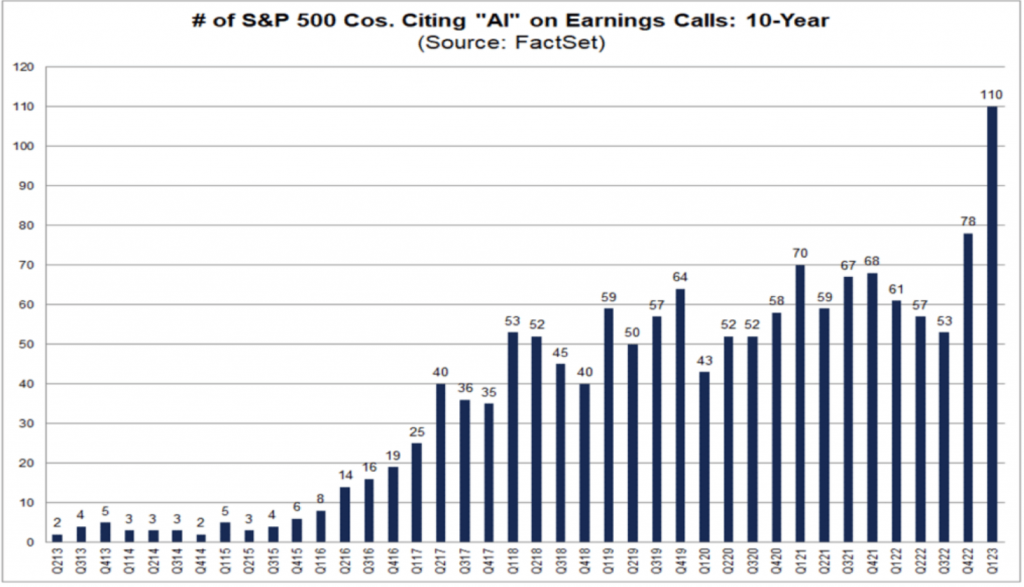

Fig 2: More companies in S&P 500 have cited “AI” during Q1 2023 earnings calls (Source: FactSet, click to enlarge chart)

Even other non-technology-related companies in the S&P 500 have started to jump onto the “AI bandwagon” in a fast and furious manner to incorporate this latest form of generative technologies into their business operations. Based on data from FactSet, 110 companies in the S&P 500 have cited “AI” during Q1 2023 earnings calls, that’s above the 5-year average of 57 and the 10-year average of 34 as well as the highest number on record so far since 2010.

AI optimism has benefited South Korean & Taiwan stock indices while other Asian cyclicals lagged

Also, this optimism in AI-equities theme play has also spread to Asia equities where Asia Pacific stock markets that are heavily weighted in related semiconductors production or development have benefited from it such as South Korea and Taiwan. Their respective exchange-traded funds listed in the US stock exchanges; MSCI Taiwan (EWT) and MSCI South Korea (EWY) have notched year-to-date gains of 18.53% and 18% respectively as of 20 June 2023 over the MSCI All Country Asia ex Japan (+2.54%). In contrast, Asian countries that are dependent on growth from external demand via the major G-20 countries such as the US and China underperformed; MSCI Singapore (-0.37%), MSCI Hong Kong (-8.78%), MSCI Thailand (-10.91%), and MSCI Malaysia (-11%).

Current AI optimism vs. boom-bust cycles of previous similar high-tech advancement narratives

Thus, how long can such optimism or exuberance in the “AI bandwagon” continue? If we argue that it is more heavily driven by the liquidity factor it implies that such FOMO behaviour can morph into a mania that can be severely out of synch with economic realities akin to the prior boom-bust cycles of similar high technology advancement narratives; dot.com of 1998, cryptocurrencies/blockchains of 2016, and smart contracts/non-fungible tokens/decentralized finance of 2020.

The widening gap between economic realities and AI optimism

The current economic reality we are facing is a slowing global economy that is characterized by a deeply inverted US Treasury yield curve where the 10-year over the 2-year is at -0.97% at this time of writing, its steepest inversion in almost 42 years.

Also, a rapid reversal of China’s economic growth since March this year after the growth spurt from Covid re-opening has dissipated that led the China central bank, PBoC to implement recent rate cuts on its three key interest rates monetary policy tools (7-day reverse repo, 1-year medium-term lending facility, & loan prime rates) within a span of two weeks.

Secondly, higher for longer interest rates environment in G-20 nations except for Japan and China.

The latest monetary policy guidance from the world’s most influential central bank, the US Federal Reserve has indicated a projection of two more rate hikes of 25 basis points (bps) each before 2023 ends on the Fed funds rate to bring the terminal rate of this current hiking cycle to a projected median level of 5.6% based on its latest dot-plot projections, an upward revision from prior 5.1%.

Market participants will be at all ears to hear more about the Fed’s stance on its current monetary policy trajectory considering the current global growth and the inflationary environment later today when Fed Chairman Powell gets quizzed by US politicians after his semi-annual testimony to the US House Financial Services Committee.

AI optimism at risk of facing a gravitational pull

Overall, a higher for longer interest rates environment is likely to further increase the costs of funding coupled with an impending global recession that may put downside pressure on corporates’ profit margins.

Given all other things being equal, such a scenario will likely trim corporates’ budgets and demand for technology hardware and software upgrades that could put a dampening effect on the current bout of AI optimism.

In the end, FOMO behaviour in stock markets without support from economic realities tends to revert to some form of gravitational pull as market participants adjust to new expectations regimes, and sometimes this “pull” maybe be painful and severe.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.