- Tokyo’s CPI for November slowed down further due to a recent drop in oil prices.

- Tokyo’s services prices accelerated to 3% y/y in November, its fastest pace since 1994.

- Japan’s latest consumer sentiment data for November also improved to its highest level since August 2023.

- A boost in consumer sentiment coupled with services inflation on the uptick indicates signs of a potential demand-driven increase in prices has emerged in Japan.

- Technical analysis suggests a further potential weakness in USD/JPY.

This is a follow-up analysis of our prior report, “USD/JPY: Japan’s inflation accelerated, a struggle for bulls at the 50-day moving average” published on 24 November 2023. Click here for a recap.

Yesterday Japan’s statistical government agency released November’s CPI data for Tokyo, which tends to be a leading economic indicator for Japan’s nationwide inflationary environment.

The headline Tokyo’s CPI print for November has continued to decelerate to 2.6% y/y from 3.3% y/y in October which indicated the lowest inflationary growth reading in around one and a half-year due to the recent drop in oil prices since late September 2023.

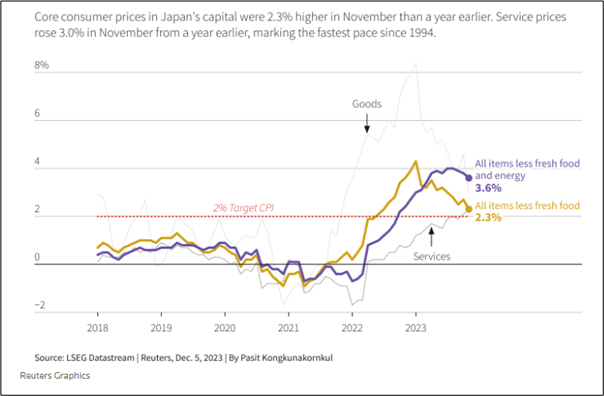

In addition, the Tokyo core-core CPI (after stripping out fresh food and energy components), a closely watched inflationary gauge by the Bank of Japan (BoJ) also slowed to 3.6% y/y from 3.8% y/y in October.

Tokyo services inflation has risen at a faster pace since 1994

Fig 1: Tokyo CPI readings for November 2023 (Source: Reuters, click to enlarge chart)

In contrast, service prices in Tokyo rose at their fastest pace since 1994 to a record gain of 3% y/y in November, indicating an increase in the odds of sustainable wage-driven inflationary growth that BoJ is monitoring to justify more tweaks to normalize its current ultra-accommodative monetary policy.

BoJ Governor Ueda has stressed in his public speeches that the recent cost-push inflation needs to be replaced by a sustainable demand-driven increase in prices backed by wage gains before BoJ can consider exiting its current short-term negative interest rate policy, an outlier among developed nations.

Another encouraging sign of a potential uptick in demand-driven domestic spending is the recent uptick in consumer sentiment in Japan where it rose to 36.1 in November from 35.7, surpassed consensus expectations of 35.6, and has been on an increasing upward trend since August 2023.

No significant change in BoJ’s monetary policy on 18 December but keep a lookout on 23 January next year

Given the “conservative modus operandi” of BoJ, it is likely that it will not make a significant policy change in the upcoming 18 December monetary policy meeting but keep a lookout on the next meeting on 23 January next year where BoJ will release its latest economic outlook report that highlights latest inflation and growth forecasts.

A rise in inflation forecast for 2024 and 2025 is likely to bring BoJ closer to ending its short-term negative interest rate policy which in turn may kickstart a herding behaviour that favors a potential further strengthening of the JPY.

Looking vulnerable for a medium-term bearish breakdown in USD/JPY

Fig 2: USD/JPY medium-term trend as of 6 Dec 2023 (Source: TradingView, click to enlarge chart)

The current four-week decline seen in the price actions of the USD/JPY since a test on its major resistance level of 151.95 on 13 November 2023 has reached the lower boundary of a medium-term ascending channel in place since 24 March 2023 low, now acting as a near-term support at 146.20.

The medium-term momentum indicator as represented by the daily RSI is still showing a bearish momentum condition (has not reached its oversold region of below 30 & continued to flash out lower lows since its bearish breakdown below the 50 level).

Hence, the ascending channel support at 146.20 may not be impregnable.

Watch the 148.40 key short-term resistance

Fig 3: USD/JPY minor short-term trend as of 6 Dec 2023 (Source: TradingView, click to enlarge chart)

The short-term downtrend phase of the USD/JPY remains intact as price actions continue to oscillate within a minor descending channel in place since the 13 November 2023 high.

The recent retest near the upper boundary of the minor descending channel on last Friday, 1 December has led to a bearish reaction in price actions that has been accompanied by a short-term bearish momentum reading seen in the hourly RSI momentum indicator (capped by a parallel descending resistance after it hit overbought reading on last Thursday, 30 November).

Watch the 148.40 short-term pivotal resistance and a break below 145.90 may trigger a medium-term downtrend phase towards the next intermediate support at 144.95/80 in the first step.

On the other hand, a clearance above 148.40 negates the short-term bearish tone to see the medium-term resistance coming in at 149.70 (also the downward sloping 20 and 50-day moving averages).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.