- Will ECB policymakers leave the door open to a March rate cut?

- UK data eyed amid division at the BoE

Eurozone GDP may leave bloc on the brink of recession

The eurozone appears to have avoided a recession at the end of last year but it may have simply been delayed.

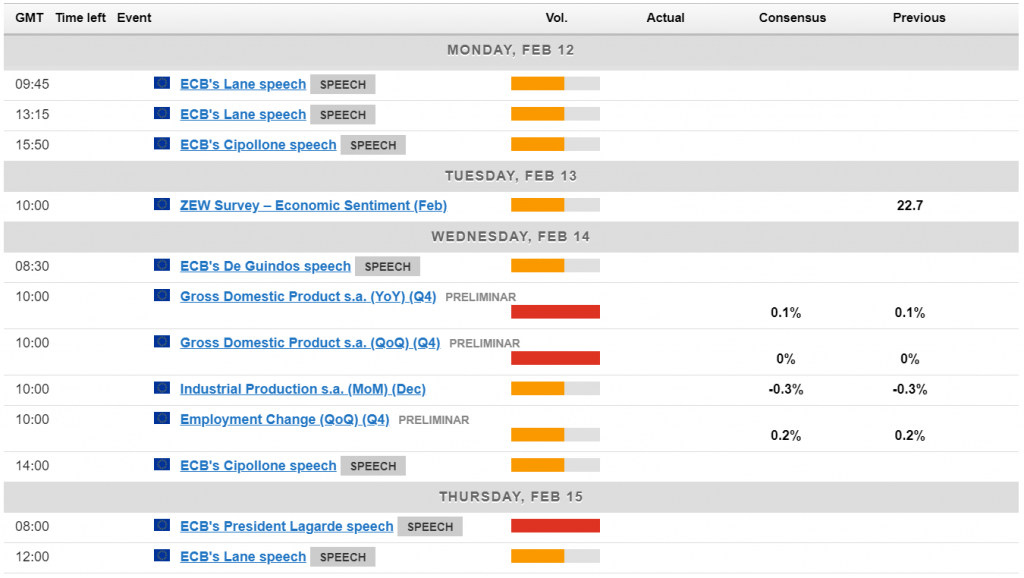

GDP data for the fourth quarter will be released on Wednesday and is expected to show the bloc didn’t grow again in the final months of the year. It will only take a slight miss to leave the euro area at risk of being in recession in the current quarter.

That said, ECB policymakers probably won’t be particularly swayed by whether the eurozone is just in technical recession or not. That it’s happening while inflation is falling – and is expected to fall much further in the coming months – may do though. And we’ll hear from a number of them next week.

EURUSD Daily

Source – OANDA

EURUSD has trended higher for most of the week after a bad start to it and an end to last. It’s run into support around the 61.8% Fibonacci retracement level which should be an interesting test going forward.

For more economic events, check out our economic calendar.

Can the BoE be convinced to cut rates in May?

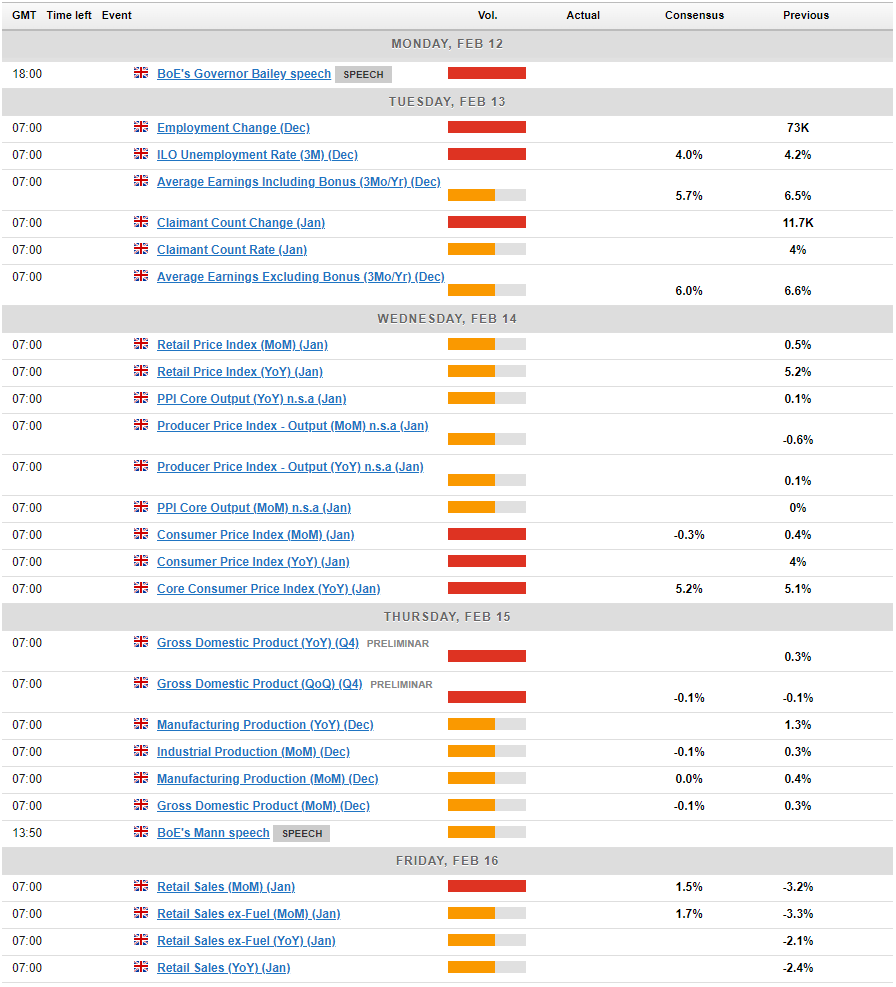

The Bank of England may not be ready to cut interest rates yet but we should have a better idea next week just how close they are.

The standout release is naturally the CPI data on Wednesday as the BoE mandate is inflation at 2% – half the level it stood at in December. Inflation is expected to fall over the coming months but a greater decline in January could help the case of cutting rates sooner. Equally, a higher number could be a massive setback and suggest progress has stalled which could see rate expectations pared back again.

The jobs report on Monday is also key, most notably the average earnings component, as this is a major contributor to price pressures. Particularly in the services sector, an area central banks are most concerned about when it comes to getting inflation sustainably back to 2%. Average earnings growth both including and excluding bonuses were above 6% in the three months to December, a level far too high to be consistent with 2% inflation.

GBPUSD Daily

Source – OANDA

The pound has rebounded against the dollar this week but that’s occurred after it broke below the neckline of a topping formation between 1.26 and 1.28. It’s retraced back to the 50% Fibonacci retracement level but has failed to break above there so far.

For more economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.