- Dollar rises to three-week high (low for euro) as labor market cools

- Atlanta’s GDPNow index rises to 3.87%, up from 3.55%

- Manufacturing contracts for a ninth straight month

The US dollar pared some its earlier gains after the JOLTS and ISM manufacturing employment component supported a Fed skip in September, possibly confirming hopes that they could be done tightening. The dollar was rallying against the euro as equities tumbled over mixed earnings and over concerns the US soft landing needs to be confirmed before we return to record levels.

US Data

The ISM Manufacturing reported contracted for a ninth straight month, as demand remains weak, but could be showing signs it is bottoming out. The headline ISM index report came in at 46.4, higher than the 46.0 prior reading, but a miss of the 46.9 consensus estimate. The prices paid component rose from 41.8 to 42.6, but was below the eyed 44.0 expectation. New orders improved from 45.6 to 47.3, while employment dropped from 48.1 to 44.4.

US job openings declined from 9.616 million openings to 9.582 million, which is the lowest levels since February 2021. JOLTS data also showed hiring decreased and the quit rate declined. The quit rate hit fell to 2.4%, the lowest level since February 2021. The ratio of job openings still makes it a job searcher market as there still remains more than 1.6 jobs for unemployed job seekers .

The labor market is clearly weakening and that is good news for the Fed. Post ISM Manufacturing and JOLTS, Treasury yields at the short end of the curve gave up some of their earlier gains.

The dollar index chart is showing that the dollar rebound over the past few weeks is facing massive resistance at around the 102.50 region. If the NFP report at the end of the week confirms that the labor market is weakening, the dollar rebound might be over.

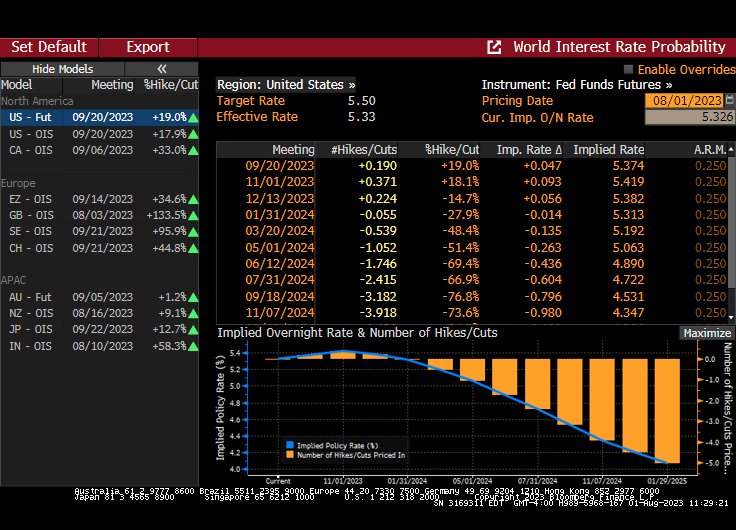

A dollar floor could be in place as Fed rate hike odds decline and rate cut odds move forward. Fed swaps will likely show the market is pricing in a coin-flip chance of a rate hike over the next two FOMC meetings or if the market grows more confident that the Fed is done.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.