- CHF was the top-performing currency among the USD pairs in the past five days.

- An uptick in geopolitical risk premium has reinforced CHF’s safe haven status.

- CHF/JPY short-term and major uptrend phases remain intact with the next intermediate resistance coming in at 167.90/168.30.

This is a follow-up analysis of our prior report, “CHF/JPY Technical: Continuation of potential bullish impulsive up move” published on 10 October 2023. Click here for a recap.

The CHF/JPY has staged the expected impulsive up move sequence and met the 165.20/165.60 intermediate resistance zone as highlighted in our previous analysis; the cross-pair printed an intraday high of 166.12 last Friday, US session, 13 October.

The current short-term uptrend phase in place since the 3 October 2023 low of 160.01 has been driven by the momentum factor supporting the CHF/JPY’s major uptrend phase since the 13 January 2023 low of 137.44.

Also, the rising geopolitical risk premium trigged by the current Israel-Hamas conflict has not abated, and now with the latest attacks orchestrated over the weekend by Hezbollah, a militant group backed by Iran on Israeli army posts in the north may have caused a further rift among key stakeholders in the Middle East region which in turn can further escalate the turmoil in the current “fragile state” of international relations affairs.

CHF maintains safe haven status but not JPY

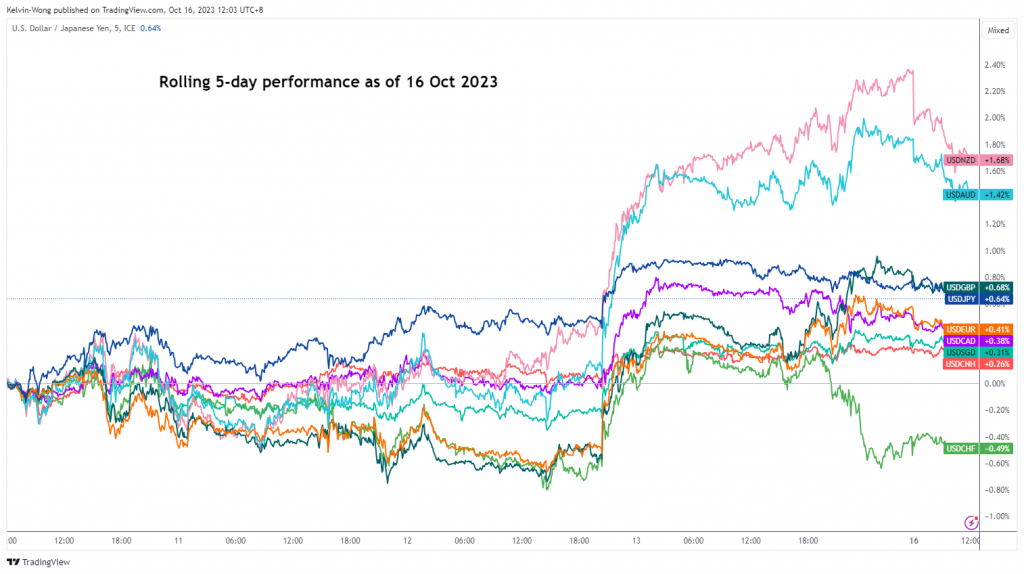

Fig 1: USD major pairs rolling 5-day performance as of 16 Oct 2023 (Source: TradingView, click to enlarge chart)

In in state of rising geopolitical tensions, the safe-haven proxy currencies, the Japanese yen (JPY) and Swiss franc (CHF) tend to be the likely outperformers in the foreign exchange market. Based on a five-day rolling performance basis as of 16 October 2023, the CHF has indeed climbed up against the US dollar where the USD/CHF rate is the worst performer among the US dollar major pairs that recorded a loss of -0.48% at this time of the writing.

However, the JPY has lost its safe haven status this time round as the USD/JPY rate has been firmed above 148.25 (the intermediate support in place since 5 October 2023) due to a “hesitant” Bank of Japan (BoJ) that does not give any clear indication of bringing forward its plans in the removal of negative interest rates policy.

Major uptrend supported by bullish momentum

Fig 2: CHF/JPY major & medium-term trends as of 16 Oct 2023 (Source: TradingView, click to enlarge chart)

After the appearance of the weekly bullish reversal “Hammer” candlestick sighted for the week ended 6 October 2023, the price actions of the CHF/JPY had a positive follow-through that led to the formation of a weekly bullish long-bodied candlestick that ended on 13 October that surpassed the highs of the prior weekly candlesticks seen in the past three weeks.

These observations coupled with an uptick seen in the daily RSI momentum indicator that has yet to reach its overbought zone (above the 70 level) suggest that medium-term bullish momentum remains intact and has increased the odds of a clearance above the 166.60 intermediate resistance (22/30 August 2023 swing highs).

164.75 is the key support to watch in the short-term

Fig 3: CHF/JPY minor short-term trend as of 16 Oct 2023 (Source: TradingView, click to enlarge chart)

Watch the 164.75 key short-term pivotal support (also the 50-day moving) on the 1-hour chart of CHF/JPY to maintain its current bullish impulsive up move sequence within its short-term uptrend phase in place since the 3 October 2023 low.

A clearance above 166.60 sees the next intermediate resistance coming in at 167.90/168.30 (a Fibonacci extension cluster).

However, a break below 164.75 negates the bullish tone for a deeper pull-back towards the next support of 163.60 (20-day moving average, 9 October 2023 minor swing low & 38.2% Fibonacci retracement of the current up move from 3 October 2023 low to 13 October 2023 high).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.