The pound has posted slight losses in the Thursday session. In North American trade, GBP/USD is trading at 1.4028, down 0.17%.

British pound slides as US inflation outperforms

The US dollar was broadly stronger on Wednesday, and the pound recorded considerable losses, falling 0.64% on the day. The catalyst for the US dollar upswing was sharply higher inflation data in April, which raised speculation that the Fed may tighten policy. Such a move would be bullish for the US dollar.

With the US economy showing strong numbers (the recent nonfarm payroll report is a notable exception), inflationary pressures have been building up. Inflation has been dormant for years but has now become a key economic factor which could significantly affect monetary policy.

The April inflation report was dramatic. Headline CPI jumped 4.2% year-on-year, up from 2.6% and above the estimate of 3.6%. On a month-to-month basis, core CPI climbed 0.9%, its highest level since 1982.

How will the Fed respond to the inflation report? Fed Chair Powell has insisted that higher inflation is transitory, but investors aren’t so sure. Global equity markets fell sharply and the US dollar rose after the inflation report, as speculation has risen that the Fed may tighten policy sooner than it anticipated.

On Tuesday, prior to the CPI release, Fed Governor Lael Brainard said that inflation risks are a “transitory surge” and urged the Fed to remain patient and continue its ultra-dovish monetary policy. Brainard pointed to the weak nonfarm payrolls report last week as an indication that the US recovery still has a ways to go, saying that, “today, by any measure, employment remains far from our goals.”

For the time being, however, the Fed remains committed to its ultra-accommodative policy. If upcoming inflation reports indicate that inflation appears to be sustainable at higher levels, the Fed may have to take a hard look at tapering QE in the coming months.

UK numbers have looked sharp this week. The March GDP report showed a strong gain of 2.1%, up from 0.4% and above the forecast of 1.3%. Manufacturing Production rose 2.1% in March, up from 1.3% and exceeding the consensus of 1.0%. As well, the NIESR GDP Estimate for April came in at +1.3%, smashing past the estimate of -1.8%. These strong numbers point to a deepening recovery in the UK, which bodes well for the British pound.

.

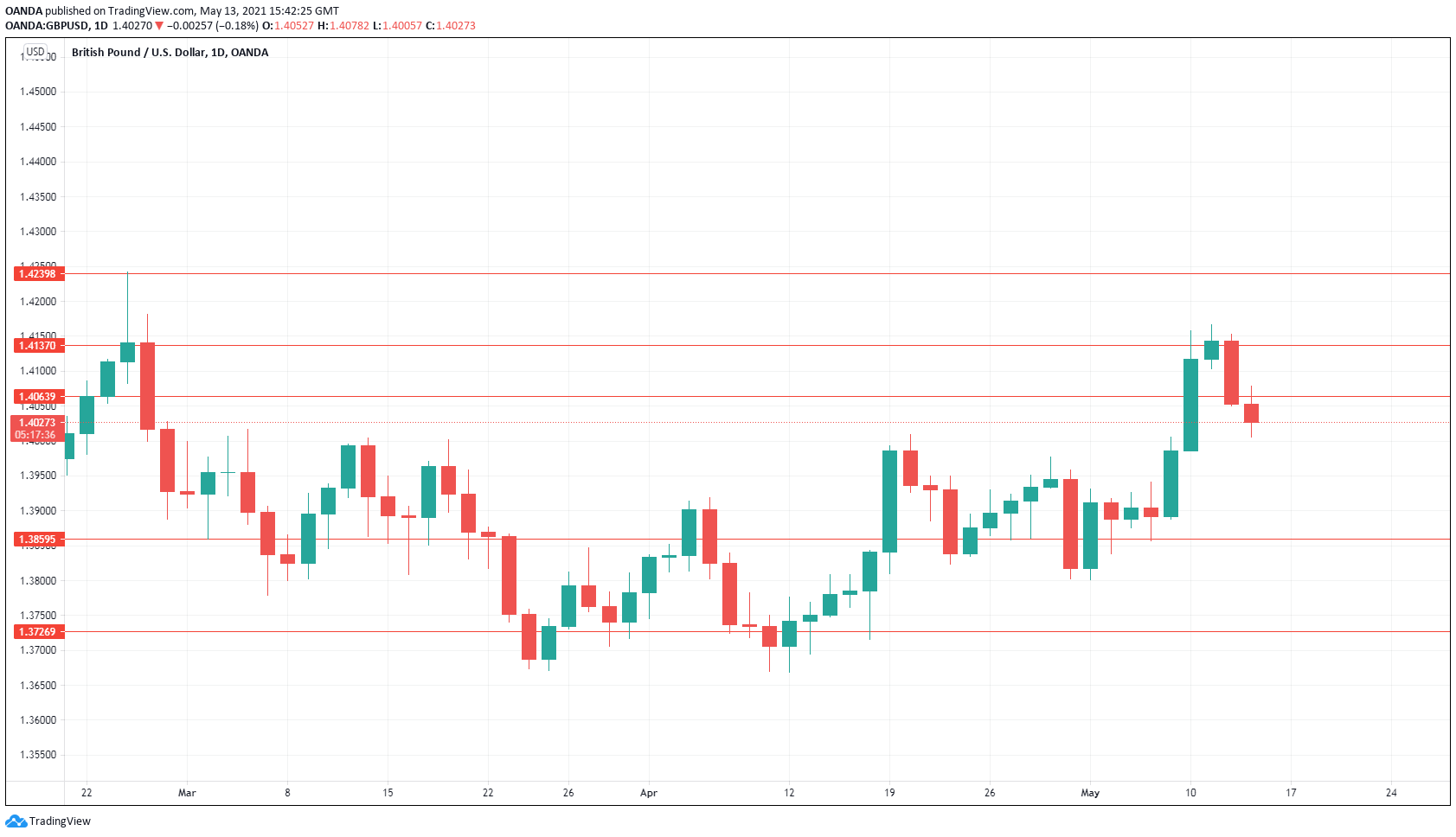

GBP/USD Technical Analysis

- GBP/USD continues to test resistance at 1.4137, followed by resistance at 1.4269.

- There are support lines at 1.3859 and 1.3727

For a look at all of today’s economic events, check out our economic calendar. www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.