Markets back in the red as tariffs increased

European markets are mostly lower at the start of the week and the US is expected to open even deeper in the red after talks between the US and China broke down and tariffs were increased.

Source – Thomson Reuters Eikon

The talks appeared to be going quite smoothly until a week ago when the cracks started to appear, since when markets have given up a chunk of their first quarter gains. There is still some hope that a deal can be reached, with a possible meeting at next month’s G20 being touted between Trump and Xi in an attempt to break the impasse.

It will now be interesting to see just how much conviction there is in the first quarter rebound, with the prospect of a Sino-US deal a big contributor to the improved sentiment in the markets. Of course, there were other important factors as well and central banks have made a significant effort to alleviate those concerns but trade tariffs are a major concern at a time when global growth is already expected to slow.

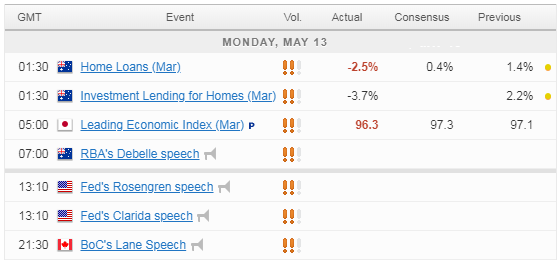

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.