Wednesday February 27: Five things the markets are talking about

Rising geopolitical tensions dominates trading this morning, sending global equities and futures lower as India clashes with Pakistan.

Note: Tensions escalated after Pakistan shot down an Indian fighter jet in Kashmir.

The yen has strengthened along with U.S Treasuries as the market waits for part-two of Fed Reserve Chairman Jerome Powell’s testimony to Congress. At yesterday’s testimony, Powell gave no indication that the Fed is prepared to alter monetary policy any time soon.

Across the pond, U.K Prime Minister Theresa May said if a vote on her Brexit deal by March 12 failed, she would offer a vote on a no-deal Brexit and then a vote on extending Article 50 (Mar 13, 14). However, PM May indicated that the third vote would only allow a “short, limited” extension of Article 50. She also said this extension still wouldn’t rule out no-deal Brexit.

Elsewhere, crude oil prices are climbing, reversing some of the losses from earlier in the week that were driven mostly by criticism from President Trump that prices are too high.

On tap: Canada inflation at 08:30 am ET and the Fed’s Powell delivers part two of his semi-annual testimony on monetary policy and the state of the economy to a House committee at 10:00 am ET.

1. Stocks mixed results

In Japan, the Nikkei closed higher overnight as investors bought into defensive stocks and real estate firms, and took profit from machinery shares that had rallied on progress in Sino-U.S trade talks. The Nikkei share average gained +0.5%, the broader Topix added +0.2%.

Down-under, Aussie shares ended higher overnight on strength in financial stocks, though some investors stayed cautious while waiting for the U.S-Korea summit in Hanoi and for details of what a Sino-U.S trade agreement might contain. The S&P/ASX 200 index rose +0.4%. Yesterday, the benchmark fell -0.9%. In S. Korea, the Kospi (+0.37%) ended higher as the Fed confirmed it’s ‘dovish’ stance.

In China, Shanghai stocks ended higher overnight, after the Fed’s Jerome Powell reinforced the U.S central bank’s recent shift towards a more “patient” approach on policy in the face of a slowing economy. The blue-chip CSI300 index fell -0.2%, while the Shanghai Composite Index rallied +0.4%. While in Hong Kong, the Hang Seng index traded down -0.5%.

In Europe, regional bourses trade lower across the board following a mixed session in Asia and lower US futures.

U.S stocks are set to open in the ‘red’ (-0.32%).

Indices: Stoxx600 -0.59% at 371.42, FTSE -0.79% at 7,095.39, DAX -0.74% at 11,456.89, CAC-40 -0.35% at 5,220.46, IBEX-35 -0.62% at 9,170.09, FTSE MIB -0.04% at 20,450.50, SMI -0.64% at 9,395.50, S&P 500 Futures -0.32%

2. Oil rallies as OPEC set to continue supply cuts, gold steady

Oil prices have rallied overnight after a report of declining U.S crude inventories and as OPEC+ seems content to stick to its supply cuts despite pressure from President Trump.

Brent crude futures are at +$65.48 per barrel, up +27c, or +0.4% from Tuesday’s close.

U.S West Texas Intermediate (WTI) crude oil futures are at +$55.89 per barrel, up +39c, or +0.7%.

Data yesterday from the API showed that U.S crude oil inventories fell by -4.2M barrels in the week to Feb. 22, to +444.3M barrels.

Crude oil prices have generally received support this year from supply curbs by OPEC+ who agreed in 2018 to cut output by -1.2M bpd to prop up prices.

Note: OPEC+ has indicated it will continue to withhold supply despite pressure from Trump this week to stop artificially tightening markets.

Expect investors to take directional support from this morning’s EIA report at 10:30 am ET.

Ahead of the U.S open, gold is holding steady despite the ‘big’ dollar trading near its three-week lows, after U.S Fed Powell reiterated that the central bank “will be patient in hiking interest rates.” Spot gold is down -0.1% at +$1,327.26 per ounce, while U.S gold futures are flat at +$1,329.

3. Strong Spanish bond sales a good sign

Spanish government bond yields are holding close to their two-year lows this morning after a very strong 15-year bond sale. Even the eurozone periphery bonds are in demand as progress in Sino-U.S trade talks continue to support a healthy demand for riskier assets.

Note: This week sees a number of periphery auctions. Expect dealers to cheapen up their curves to take down supply.

This morning, Spain’s 10-year bond yield has fallen to a 28-month low of +1.126% after yesterday’s sovereign sale and holding near to that level this morning has pulled Italian and Portuguese equivalents lower too.

Also providing some support for E.U regional product is the fact that the Fed’s Jerome Powell threw up no surprises yesterday – the Fed is in no rush to makes any changes to interest rates anytime soon, decisions are “data dependent.”

Elsewhere, the yield on U.S 10-year Treasuries has eased -1 bps to +2.63%, the lowest in a month. In Germany, the 10-year Bund yield fell less than -1 bps to +0.11%, while in the U.K, the 10-year Gilt yield has climbed less than +1 bps to +1.21%, the highest in three-weeks.

4. Dollar’s slippery slope

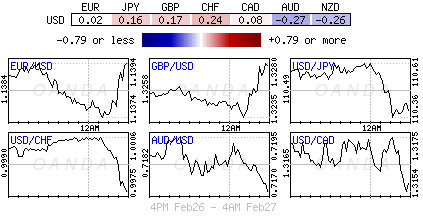

Ahead of the U.S open, the ‘mighty’ USD is on ‘soft’ footing in the aftermath of Fed Chair Powell’s semi-annual testimony in Congress and seems well contained within recent quarterly ranges for G10 currency pairs. The Fed chair reiterated that policy decisions would continue to be “data dependent” and that in no rush to make a judgment about changes in policy.

Sterling (££1.3294) trades atop its six-month high as PM May bought herself more time to secure a Brexit agreement. With a little more than a month to go before the UK’s scheduled exit from the E.U, lawmakers have yet to settle on a deal with the bloc.

The EUR is unmoved by the weakening consumer sentiment in Europe, given that it had already risen to the key psychological level of €1.14 on the back of a weaker dollar. Analysts are anticipating that the ‘single’ unit will begin to struggle to rise from here. Strong resistance at €1.1425-30.

5. Eurozone slowdown fears underlined by weak money & lending data

Data this morning showed that Bank lending to eurozone businesses slowed sharply last month, supporting recent evidence of an economic slowdown in the region.

According to the ECB, lending to non-financial corporations grew +3.3%, down from an annual growth rate of +3.9% in the previous month.

The ECB’s key indicator of the money supply, M3, grew +3.8% y/y through January, down from December’s +4.1% growth rate. Markets were looking for a +4% growth.

A positive in today’s report was that lending to households was stable in January. It rose +3.2% y/y, the same as in December 2018.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.