60 day extension a bullish catalyst

Optimism around Sino-US trade talks is continuing to provide a boost for equity markets on Thursday, with a meeting between President Xi and top US officials on Friday being closely monitored.

Trump’s claim that negotiations are going “very well” and reports that a 60 day extension is being considered is encouraging. This was always, realistically, the best possibly outcome of these initial talks and I think we have to be pleased that this means two more months without new tariffs. The ultimate goal is for previous tariffs to be removed entirely but this is another important step towards that.

It’s difficult to know exactly what impact the tariffs have had on the trade data so far, with figures suggesting there was some front-loading of Chinese exports prior to them being imposed. But data overnight – assuming it’s reliable – suggests they’re continuing to hold up well, with exports surging by 9.1% in January, smashing market expectations of a 3.2% decline. The timing of Chinese New Year always makes the data at the start of the year more difficult to interpret, which can lead people to take it with a pinch of salt.

Japan shares boosted by GDP rebound

Germany avoids recession, just

There hasn’t really been much of a bullish case for the euro recently and Germany avoiding falling into recession by the skin of its teeth in December doesn’t exactly inspire any change in that. The GDP data for the fourth quarter fell short of analyst expectations of 0.2%, with the economy instead flatlining. The number is subject to revision though so it may be too early to celebrate just yet.

Dollar powers on but gold remains resilient, for now

The dollar on the other hand is putting up quite a fight, despite the widespread belief a few months ago that it was going to be a challenging year for it. It certainly got off to a tough start but it’s been on quite a run this month and is up more than 2% from the end of January lows. The positive noises around trade talks took the wind out of its sails over the last couple of days, with progress generally being a bearish story for the greenback, but it continues to grind higher.

Gold (Orange) vs USD (Purple) Daily Chart

Source – Thomson Reuters Eikon

This is keeping the pressure on gold which tends to struggle against the backdrop of a stronger dollar. It’s showing some admirable resilience itself though and continues to trade above $1,300 but this will only last so long. At some point, the relationship will likely resume and it’s just a case of who can hold their nerve longer, gold bulls or dollar bulls.

New Zealand gives US dollar birds

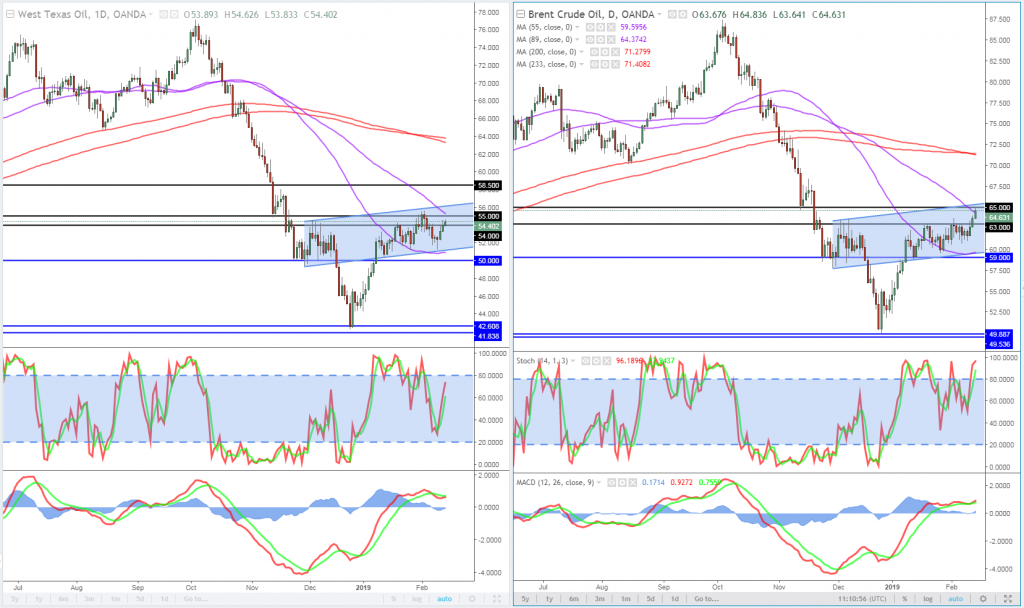

Oil testing major resistance on Saudi cut

The dollar rally isn’t holding oil back either, with WTI and Brent now pushing previous resistance levels and threatening a very bullish breakout. There has been significant resistance around $55 and $65, respectively, for some time and these are both currently coming under pressure. The newsflow recently has certainly been more bullish, particularly reports of Saudi Arabia exceeding production cut targets by 500,000 barrels per day, and this has been the catalyst for the current bout of strength.

Oil (WTI and Brent) Daily Chart

OANDA fxTrade Advanced Charting Platform

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.